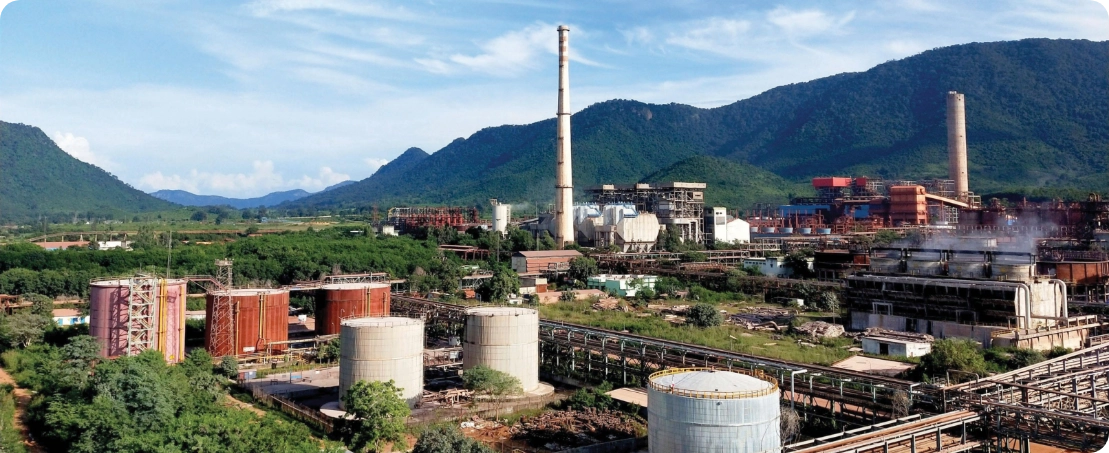

Zinc India is in first decile of the global zinc mining cost curve. It achieved highest ever mined metal production of 1,079 kt, increased by 2% Y-O-Y on account of improved mined metal grades and recorded 3rd largest silver production globally at 746 mt grew by 5% Y-O-Y in line with management’s operational and financial strategy.

Best-ever mined metal production

Highest-ever refined

Highest-ever silver production

In line with our commitment to ensure zero harm to employees, the leadership has undertaken the prime responsibility of providing a safe workplace for all the employees entering our premises. Setting a milestone in FY 2023-24, in-line with our commitment to ‘Zero Harm’ we have achieved zero fatalities in this financial year.

LTIFR for the year was 0.88 as compared to 0.70 in FY 2022‑23.

To avoid fatalities and catastrophic incidents in the Company, ‘Vihan’: a critical risk management (CRM) initiative was launched in FY 2022-23 to improve managerial control over rare but potentially catastrophic events by focussing on the critical controls. Through the initiative, we have reinforced the focus upon seven more risks in FY 2023-24.

In alignment with our vision of zero-harm, Hindustan Zinc Limited introduced 'SURAKSHA KAVACH' phase I of fatality prevention controls initiative for underground mining operations which can proactively address potential risks associated with activities conducted at our sites, encompassing 25 diverse activities, both routine and non-routine, for underground mining operations in Phase I. It outlines clear NO-GO criteria and critical checks that must be conducted by our statutory supervisors and competent personnel.

During the reporting period, safety pause was conducted across all our operational units under the theme ‘stop work if it’s not safe’. During this connect, all recent safety incidents that had occurred across the Group were discussed and key learnings were shared. The programme was organised by business partners in all the three shifts, including the night shift.

In line with our vision of ‘zero-harm’ and to prevent reoccurrence of similar fatalities within the Group, we have launched infrastructure Inframatrix across Hindustan Zinc for 9 top risks that exist in our business. It helps to eliminate the probability of occurrence of fatalities for the identified critical risks in the business by improving the infrastructure of various risks.

A 10-day capacity-building training programme on disaster management was conducted by the National Disaster Response Force (NDRF) emergency response at Dariba Smelting Complex (DSC). The training covered various aspects including medical first response, collapsed structure search and rescue, fire management, and chemical and gas disaster management emergencies.

To further enhance the safety of our assets and facilities, Hindustan Zinc established the 'Structure Integrity Management' community. This community is dedicated to predictive assessment, corrosion mapping, and timely rectification of old, damaged, and corroded structures within the plant, ensuring the safety and reliability of our operations.

For demonstrating a higher degree of safety, we have been awarded with below awards:

Hindustan Zinc has received validation on its near-term and net-zero targets by the Science Based Targets initiative (SBTi). Our targets include a commitment to reduce 50% of absolute scope 1 and 2 GHG emissions and further reduction of 25% of absolute scope 3 GHG emissions by FY 2029‑30 from the base year FY 2019-20 and achieving net-zero emissions across the value chain by FY 2049-50. These target ambitions have been approved by the SBTi in line with 1.5°C trajectory. We also became the only company in India to be shortlisted for setting Science Based Targets for Nature (SBTN) based on which we will set targets against freshwater and land.

In FY 2022-23, we signed renewable energy supply agreement of 450 MW round-the-clock renewable energy (RE-RTC), the project is progressing well and the Company is expected to start receiving renewable energy from April 2024. This 450 MW RE-RTC will help us reduce our GHG emissions significantly by 2.7 million tCO2e per annum.

We have deployed 2nd BEV in our underground operations at Sindesar Khurd Mine. We have taken a significant leap towards sustainable logistics by signing an agreement which marked the deployment of 10 EV Trucks, each boasting a capacity of 55 mt, helping in interunit transport of goods and reduction of Scope 3 emissions.

Hindustan Zinc has led by example by inducting an LNG powered truck for upstream and downstream transportation which shall reduce GHG emissions. With their deployment, we will reduce our carbon footprint by 30% in comparison to traditional diesel vehicles, thereby reducing Scope 3 emissions.

The Company is also working along with International Zinc Association (IZA) and its climate action taskforce for standardisation of Scope 3 emissions guidelines across the zinc sector.

The Company has inaugurated a 4,000 KLD zero liquid discharge (ZLD) plant phase 1 at Zawar Mines, which utilises advanced technology to help in water conservation. The plant has resulted in reduction of freshwater dependency, aligning with the vision of becoming 5 times water positive by 2025.

Dry tailing plant at Rajpura Dariba mine is in progress and will result in significant amount of water recovery from the tailings.

The 3-year engagement with International Union for Conservation of Nature (IUCN) is in progress with 3rd season assessment completed. Under this, we have prepared an integrated biodiversity assessment tool (IBAT) report for all Rajasthan-based locations. Site visit by IUCN team members was done for three seasons. These studies will help the Company prepare a strategy to achieve ‘no net loss’ towards biodiversity.

First fuming furnace commissioning was completed at Chanderiya Lead Zinc Smelter (CLZS) which will help us in improving metal recovery and reducing the generation of jarosite waste.

As a significant achievement in our pursuit of reducing waste by improving efficiency, Hindustan Zinc received two Indian patents titled “Method for production of lead by performing dross removal procedures” and “Method for production of zinc by utilising lead plant slag”.

We organised a series of training sessions called "Wednesday for Transition", which were designed to provide suppliers with essential knowledge on ESG (Environmental, Social, and Governance) topics.

Consent to Establish was granted for PAP (Phosphoric Acid Plant) in March 2024 by State Pollution Control Board. The project includes the establishment of PAP plant with a capacity 240 KTPA inside CLZS complex based on Hemidihydrate (HDH) technology.

Environment clearance was granted for CLZS expansion project in December 2023 by the Ministry of Environment, Forest, and Climate Change ((MoEF and CC). The project includes expansion of pyro metallurgical smelter unit and other debottlenecking projects in CLZS.

Our sustainability-related activities received several endorsements during the reporting period:

FY 2023-24 recorded the best-ever Mined Metal production of 1,079 kt compared to 1,062 kt in the prior year driven by improved mined metal grades. For the full year, ore production was lower by 1% Y-O-Y to 16.52 million tonnes on account of lower ore production at Zawar, Kayad and Rajpura dariba mine.

Silver recorded the highest volume in FY 2023-24 in line with management’s operational & financial strategy, at 24.0 moz up 5% Y-O-Y. Refined lead production was at 216 kt, up 3% Y-O-Y.

In CY 2023, zinc price lost its shine as macro headwinds deterred investor sentiments, and unsustainable metal surpluses got piled up. Zinc LME ended FY 2023-24 at 2,391 US$/t which is 17.8% lower than 31 March 2023. At supply level, the refined zinc production increased by 1.5% to 13.8 million tonnes in CY 2023.

However, with expectations of interest rate cuts by the US Fed and geopolitical tensions in the Middle East, commodity prices went on a rally starting April 2024, with silver touching its highest in ₹ terms. Chinese manufacturing PMI has also increased from 50.9 in February to 51.1 in March, entering into expansion zone for the first time since September 2023.

The global refined zinc demand contracted by 1.5% to 13.4 million tonnes in CY 2023, largely due to a fall in Chinese, USA, EU regions. An increase in supply created a surplus in the market resulting to an increase in the warehouse (LME & SHFE) stocks by 386% (50 kt to 243 kt) and consequent increase in pressure on metal premiums on a spot basis.

The market anticipated that the removal of COVID restrictions in 2023 would signal a strong rebound in the Chinese economy and zinc demand. This optimism, however, turned out to be misguided, as the recovery has been stifled by the structural slump in the real estate industry as well as exceptionally low levels of confidence among consumers and businesses. Therefore, the combination of Government-backed stimulus programmes and strong export demand for Chinese-made galvanised sheets, white goods, and automobiles drove the zinc consumption in 2023.

European continent's zinc consumption also undergone a structural shift due to permanent capacity closures caused by rising energy prices, even though they have decreased. This is especially the case in Germany, where the effects of increasing energy costs have been most pronounced. US economy went through demand slump in 2023 on account of rising interest rates, rising unemployment and couple of other macroeconomic factors.

In terms of demand, India has surpassed the globe. The Indian economic environment has remained optimistic. The same was reflected by the S&P Global Manufacturing PMI which stood at 59.2 in March 2024 as compared to 56.4 in March 2023, reflecting expansion in the manufacturing sector. This highlighted 31 successive monthly improvement in operating conditions. The domestic production of finished steel went up by 13.2% to 118.947 million tonnes from April 2023 to January 2024 (P). Consumption in domestic market during the same period stood at 112.5 million tonnes, up by 14.5%. The total net finished steel exports till Jan’24 stood at 5.5 million tonnes, up by 3.6%.

For the full year, Zinc COP excluding royalty was US$ 1,117 per tonne, down by 11% Y-O-Y (8% lower in ₹ terms). The reduction in COP has been achieved mainly due to lower coal and input commodity prices, better grades & better linkage coal availability.

Revenue from operations for the year was ₹ 27,925 crore, degrew by 16% Y-O-Y, primarily on account of lower zinc LME prices and zinc metal volume, partially offset by favourable exchange rates, higher silver and lead prices and volume. EBITDA for FY 2023-24 was at ₹ 13,562 crore, down by 22% Y-O-Y in line with the lower revenues.

As Zinc India advances in the journey of 1.25 MTPA metal in concentrate (MIC) expansion, several projects have been undertaken throughout the year:

Zinc India’s exploration objective is to upgrade the resources to reserves and replenish every tonne of mined metal to sustain more than 25 years of metal production by fostering innovation and using new technologies. The Company has an aggressive exploration programme focussing on delineating and upgrading Reserves and Resources (R&R) within its licence areas. Technology adoption and innovations play key role in enhancing exploration success.

The deposits are ‘open’ in depth, and exploration has identified number of new targets on mining leases having potential to increase R&R over the next 12 months. Across all the sites, the Company increased its surface drilling to assist in Resource addition and upgrading Resources to Reserves.

In line with previous years, the Mineral Resource is reported on an exclusive basis to the Ore Reserve and all statements have been independently audited by SRK (UK).

On an exclusive basis, total Ore Reserves at the end of FY 2023-24 stood at 175.1 million tonnes (net of depletion of 16.5 million tonnes during FY 2023-24) and exclusive Mineral Resources totalled 281.2 million tonnes. Total contained metal in Ore Reserves is estimated at 9.9 million tonnes of zinc, 2.8 million tonnes of lead and 312.2 million ounces of silver. The Mineral Resource contains approximately 12.7 million tonnes of zinc, 5.5 million tonnes of lead and 542.1 million ounces of silver. At current mining rates, the R&R underpins metal production for more than 25 years.

Our primary focus remains on enhancing overall output, cost efficiency of our operations, improving cost efficiency in our operations, maintaining disciplined capital expenditure, and ensuring sustainable operations. Despite the current economic uncertainty, our goals over the medium term remain unchanged.

During FY 2023-24, Zinc International recorded annual production of 208 kt. The significant decline in production for the year was mainly due to ore availability challenges, significantly lower throughput, and lower zinc and lead grades at both units.

Black Mountain production for FY 2023-24 stands at 61 kt down by 6% Y-O-Y, due to lower zinc and lead head grades partly offset by higher tonnes treated and better recoveries.

Gamsberg production for FY 2023-24 is down 29% Y-O-Y due to lower mining volumes driven by West pit geotechnical issue and lower grades.

Skorpion Zinc has been under Care and Maintenance since start of May 2020, following cessation of mining activities due to geotechnical instabilities in the open pit. Activities to restart the mine are still in progress.

MIC production

At Vedanta Zinc International (VZI), we prioritise the health and safety of our employees and stakeholders, and we remain committed to timely and transparent communication with all parties involved.

Airborne particulate management remains a key focus in reducing lead and silica dust exposures of employees (Exposure Reduction to Carcinogenic). Zero new HIV and any other Occupational Related Diseases for the year. VZI had 8 blood lead withdrawals for FY 2023-24 (a reduction from 17 in the previous year), against more stringent limits than required by law. We have strengthened our Employee Wellness Programme through weekly training and empowerment sessions presented by our Wellness Coordinator at our training centres as well as focussing on the increased participation of employees and communities in VCT for Aids / HIV, blood donation and wellness. Upgrade of BMC Occupational Health & Primary Health Care facility is also underway to improve space and flow within the facility. VZI has also embarked on a real-time monitoring strategy and additional controls at source to reduce and eliminate exposures to both silica and lead.

The VZI LTIFR for FY 2023-24 YTD regressed from 0.75 in FY 2022-23 to 1.26 in FY 2023-24. The TRIFR remained within the guidance of 3 per million-man hours worked in FY 2023-24 at 3.6. The regression in LTIFR was attributed to low energy types of injuries such as slipping and falling as well as manual handling of material. Short-term awareness campaigns such as “Season of Exceptional Care” were implemented to ensure that employees remain focussed whilst at work and return home to their families safe and healthy every day.

VZI has secured Portion 1 of the farm Wortel 42 as the fifth Biodiversity Offset Property and has presented the property to the Department of Agriculture, Environmental Affairs, Rural Development and Land Reform (DAERDLR) for declaration as part of the Gamsberg Nature Reserve (Protected Area under the National Environmental Management Protected Areas Act, 2003 (Act No.57 of 2003). Once declared, the property will be transferred to the Department of Public Works. This is a requirement of Clause 6 of the Biodiversity Offset Agreement (BOA).

During the reporting period, Gamsberg successfully renewed the Salvage yard waste licence that expired on 31 December 2023 and will be valid for the next 10 years. Gamsberg and Black Mountain Mine further maintained its ISO 14001:2015 certification. The Project offices achieved a Green Building Certification.

Total production for the year was 208 kt, down by 24% Y-O-Y. This was primarily due to lower tonnes treated and lower grades.

At BMM, production for the year 61 kt, down by 6% Y-O-Y. This was mainly due to lower lead grades (2.6% vs 3.0%) and lower zinc grades (1.6% vs 1.8%) offset by 0.1MT higher throughput (1.8 mt vs 1.7 mt), higher zinc recoveries (78.3% vs 71.9%) and higher lead recoveries (85.4% vs 82.8%).

At Gamsberg, production for the year was at 147 kt, down by 29% Y-O-Y. The low production at Gamsberg is attributable to mining underperformance resulting in lower ore availability, and lower zinc grades (5.6% vs 6.5%).

At Skorpion Zinc engagement with technical experts to explore opportunities of safely extracting the remaining ore is ongoing. The business is currently evaluating options to restart mining.

Overall Zinc COP including TcRc for the year was US$ 1,488 per tonne, down by 6% This was mainly driven by lower mining and other costs, lower treatment and refining charges, higher production of copper, local currency depreciation against the US$ partially offset by lower production.

Revenue for the year was ₹ 3,556 crore, down by 32%, mainly due to significantly lower production volumes, and lower LME prices offset by lower treatment charges.

EBITDA for the year was ₹ 693 crore, down by 64% mainly due to lower production volumes, and lower LME prices partly offset by impact of exchange rate movement on cost, lower mining cost and lower treatment charges.

The Skorpion Refinery Conversion project was at Ready-to-order stage, post completion of FEED, feasibility study, tendering activities, techno-commercial adjudication, contract finalisation, and now currently on hold pending finalisation of power tariff.

The application for environmental clearance renewal certificate for the refinery conversion project has been submitted and waiting for approval. Confirmation on agreed power tariff is awaited to take the final decision and start the project execution on ground.

Gamsberg Phase 2 project includes the mining expansion from 4 MTPA to 8 MTPA and Construction of New Concentrator plant of 4 MTPA, taking the total capacity to 8 MTPA ore. Owner’s Engineering consultant has been appointed for conducting pre-feasibility studies, executing the basic engineering design, detailed engineering review, quality assurance and site construction management.

All activities related to tendering, techno-commercial adjudication, contract finalisation have been completed. All Major Long-Lead Free Issue Materials {Ball and Sag Mill (CITIC), Crusher, Floatation, Filter Presses and Thickeners Package (MO)} Orders placed. Major FIM supplies such as Thickeners, Mills, Transformers have been delivered to Project Site. Project is targeted to be completed by H1 FY 2024-25

The status on the project is as follows:

This is a project to recover iron ore (magnetite) from the BMM fresh tailings. Detailed engineering and procurement have been completed and construction progress is at 76%. The project was on hold due to EPC Business partner (LeadEPC) going into Business Rescue (BR).

LeadEPC came out of BR in the third quarter of FY 2023-24. Team started mobilisation in February 2023-24, and have planned to complete the project by the second quarter of FY 2024-25. All the environmental approvals are in place to process fresh tailings and extract Iron Ore.

Zinc International continues to remain focussed to improve its Y-O-Y production by sweating its current assets beyond its design capacity, debottlenecking the existing capacity, and adding capacity through Growth Projects. Our immediate priority is to ramp-up the performance of Gamsberg mining operations and simultaneously complete Gamsberg Phase 2 project to add another 190 kt to the total production of VZI. Likewise, BMM continues to deliver stable production performance and focus is to debottleneck its ore volumes from 1.7 mt to 2.0 mt. Skorpion is expected to remain in Care and Maintenance while management is assessing feasible and safe mining methods to extract ore from Pit 112. Zinc International continues to drive cost reduction programme to place Gamsberg operations on 1st Quartile of global cost curve with COP< US$ 1,200 per tonne.

During FY 2023-24, Oil and Gas business delivered gross operated production of 128 Kboepd, down by 11% Y-O-Y, primarily driven by natural reservoir decline at the MBA fields. The decline was partially offset by addition of volumes through new infill wells brought online in Mangala, Aishwariya, Bhagyam and Raageshwari Deep Gas fields. OALP assets were supported by ramp-up of volumes from Jaya discovery.

Average gross operated production

There were two lost time injuries (LTIs) in FY 2023-24. Frequency rate stood at 0.06 per million-man hours (FY 2022-23: 0.03 per million-man hours).

Our focus remains on strengthening our safety philosophy and management systems. We were recognised with awards conferred by external bodies:

Cairn Oil and Gas has taken various initiatives:

Our Oil and Gas business is committed to protect the environment, minimise resource consumption and drive towards our goal of ‘zero harm, zero waste, zero discharge’.

Average gross operated production across our assets was 11% lower Y-O-Y at 127.5 Kboepd. The Company’s production from the Rajasthan block was 106.5 Kboepd, 11% lower Y-O-Y and from the offshore assets, was at 19.7 Kboepd, 13% lower Y-O-Y. The natural decline has been partially offset by infill wells brought online across all assets.

Gross production from the Rajasthan block averaged 106.5 Kboepd, 11% lower Y-O-Y. The natural decline in the MBA fields has been partially offset by infill wells brought online in Mangala, Aishwariya, Bhagyam, ABH and RDG fields.

Gas production from Raageshwari Deep Gas (RDG) averaged 140 million standard cubic feet per day (mmscfd) in FY 2023‑24, with gas sales, post captive consumption, at 116 mmscfd.

The appeal against the Division Bench order (additional 10% profit sharing from 2020 onwards) was filed by us before the Supreme Court in June 2021. The matter was part heard on 16 February 2023 and mentioned by the Company several times for early listing. We await the next date of hearing.

The Government of India (GoI), acting through the Directorate General of Hydrocarbons (DGH), had raised demand up to 14 May 2020 for Government’s additional share of Profit oil based on its computation of disallowance of cost incurred over retrospective re-allocation of certain common costs between Development Areas (DAs) of Rajasthan Block and certain other matters aggregating to US$ 1,162 million applicable interest thereon representing share of Vedanta Limited and its subsidiary.

We had disputed the aforesaid demand and invoked arbitration as per the provisions of the Production Sharing Contract. The Company had received the Final Partial Award dated 22 August 2023 from the Arbitration Tribunal ('the Tribunal') as amended by orders dated 15 November 2023 and 08 December 2023 ("the Award"), dismissing the Government’s contention of the additional Profit Petroleum in relation to allocation of common development costs across Development Areas and certain other matters in accordance with terms of the Production Sharing Contract for Rajasthan Block, while disallowing some matters. Further, Tribunal has decided that the Company is allowed to claim cost recovery of exploration cost for the purpose of computation of Profit Oil.

Pursuant to the award, the Company has recognised a benefit of US$ 578 million in revenue from operations.

The Gol had sought an additional award or interpretation/ clarification on certain matters decided by the Tribunal under the Indian Arbitration and Conciliation Act, 1996 ("the Act") ("Gol Applications"), The Tribunal vide its orders dated 15 November 2023 and 08 December 2023 has dismissed Gol Applications, in favour of the Company.

GoI had filed interim relief application on 03 February 2024 seeking stay on further recovery by Company and return of amounts already recovered. The matter was heard on 26 March 2024 and we await order of Tribunal’s order in this regard.

GoI on 07 March 2024 filed application before Delhi High Court challenging the Final Partial Award and matter was heard on 14 March 2024. No stay was granted and the petition was not admitted. The next date of hearing is 22 April 2024. The Company is of the view that there is no merit in the challenge filed by GoI, as the Court cannot re-appreciate the evidence in Section 34 appeal. The interpretation by the Tribunal is plausible and therefore no challenge is merited.

The Group has adjusted the liability as on 31 March 2024 of US$ 233 million against the aforesaid benefits recognised per the Arbitration award.

The Ravva block produced at an average rate of 10.8 Kboepd, lower by 8% Y-O-Y, owing to natural field decline.

The Cambay block produced at an average rate of 8.9 Kboepd, lower by 17% Y-O-Y, owing to natural field decline.

Crude oil price averaged US$ 83.1 per barrel in FY 2023-24 representing decrease from US$ 96.2 per barrel. The decline is largely attributed to ongoing geopolitical risk, concerns about demand in major economies like the US and China, monetary tightening by major banks and expectations of global oil production surpassing consumption in 2024. Previous period was influenced by Russia-Ukraine war which resulted in rally in prices.

Early in the year, prices fluctuated due to supply and demand factors. On the supply side, limited availability due to increase in U.S. crude and gasoline inventories, concerns about production cuts, sanctions on Russia contributed to volatility. Additionally, demand was influenced by structural uncertainties, such as looming possibility of U.S. debt default potential and a slowdown in China’s economy.

However, in September and October optimism emerged as expectations grew that central banks were approaching the end of their tightening cycles. Additionally, the decline of US Dollar and anticipated economic stimulus in China added to the positive sentiments. Firm demand for crude in the spot market, rising global refinery intakes, stronger refining margins and a large draw in US crude stocks boosted the prices.

Despite these developments, the oil market remains shrouded in uncertainty and susceptible to ongoing fluctuations due geopolitical risk surrounding the Middle East and Russia, disruptions in maritime trade flows, persistent worries about the demand outlook in the US and China, compounded by global petroleum reserves and unexpected supply disruptions in several regions.

Revenue for the year was ₹ 17,837 crore (after profit petroleum and royalty sharing with the Government of India), up 19% Y-O-Y, as a result of favourable order received in GoI Arbitration partially offset by fall in oil prices. EBITDA for FY 2023-24 was at ₹ 9,777 crore, up by 26% Y-O-Y in line with the higher revenues.

The Rajasthan operating cost for the year was US$ 14.5 per barrel compared to US$ 14.2 per barrel in previous year, primarily driven by lower production and increased well interventions to manage natural field decline.

The Oil and Gas business has a robust portfolio of infill development and enhanced oil recovery projects to add volumes in the near term and manage natural field decline. Some of key projects are:

Based on the success of the infill drilling campaigns in Mangala field, opportunities to further accelerate production by drilling and hook up of 18 wells (15 producers and 3 injectors) in FM1 sands were identified. The project also entails conversion of 6 wells.

As of 31 March 2024, 8 wells have been drilled, of which 6 wells are online.

Based on the success of the polymer injection in Lower Fatehgarh (LF) sands of Aishwarya field, additional production opportunities were identified in Upper Fatehgarh (UF) sands. The project entails drilling of 25 infill wells in Upper Fatehgarh (UF) sands and conversion of 7 existing wells to UF polymer injectors.

As of 31 March 2024, 24 wells have been drilled, of which 21 wells are online.

In order to realise the full potential of the gas reservoir, an infill drilling campaign of 25 wells was executed. Project has been completed during second quarter of fiscal year 2024 and all wells are online.

To augment reserves and manage natural decline, we commenced additional 8 infill wells drilling campaign during fiscal year 2024. As of 31 March 2024, 6 well has been drilled of which 3 wells are online.

To accelerate production and augment reserves from Bhagyam field, infill drilling opportunities in FB1 and FB3 layers were identified. The project entails drilling of 9 infill wells in FB3 layers and three horizontal wells in the bio-degraded zone.

As of 31 March 2024, project is completed, and all wells are online.

Aishwarya Barmer hill infill drilling programme established confidence in reservoir understanding of ABH. Based on its success, drilling of 14 additional wells were conceptualised.

As of 31 March 2024, 8 wells have been drilled of which all are online. The projects work on surface facilities are currently in progress.

In order to monetise the satellite fields, 14 wells development campaign for 3 satellite fields (GSV, Tukaram, Raag Oil) was conceptualised. Drilling was completed during FY 2022-23 of which 9 wells are online as on date

Under the Open Acreage Licensing Policy (OALP), revenue-sharing contracts have been signed for 51 blocks located primarily in established basins, including some optimally close to existing infrastructure, of which 5 onshore blocks in the KG region have been relinquished.

During FY 2023-24, we drilled eight exploration/appraisal wells [4 wells in Cambay Onshore (YME-1 Jaya Appraisal and Jaya SW1, Jaya SW1-ST, and Jaya SW-3), 1 well in Western Offshore (Dwarka 1) and 3 wells in Rajasthan (Durga Lateral 1, and Durga Lateral 2 and Western Margin GH-1A)].

Through exploration and appraisal successes encountered in Cambay Onshore (Jaya) wells, we have got approval for Field Development Plan (FDP) to produce >3,000 boepd. This will be the first FDP in OALP regime, among 144 blocks awarded under 8 OALP rounds by the Government to various companies.

Seismic Acquisition activities are ongoing in the North‑East and Cambay region.

Vedanta’s Oil and Gas business has a robust portfolio mix comprising exploration prospects spread across basins in India, development projects in the prolific producing blocks and stable operations which generate robust cash flows.

The key priority ahead is to deliver our commitments from our world-class resources with ‘zero harm, zero waste and zero discharge':

With our continued focus on operational excellence, improving asset reliability across units and efficiency in procurement, we have achieved highest ever annual cast metal production of 2.37 million tonnes in FY 2023 ‑24, up 3% Y-O-Y, and achieved hot metal cost of US$ 1796/T, 23% lower Y-O-Y. We also produced 1.81 mt of calcined alumina, up 1% Y-O-Y.

In addition, as the first milestone in our transformational capex programme, we produced the first alumina from Train 1 of the Lanjigarh refinery expansion project, as a step towards becoming a fully vertically integrated Aluminium producer.

Highest-ever aluminium production

We report with deep regret one fatality of business partner employees during the reporting period at Jharsuguda site. We have thoroughly investigated all the incidents and the lessons learned were shared across all our businesses to prevent such incidents in future.

This year, we experienced a total of 33 Lost Time Injuries (LTIs) resulting in an LTIFR of 0.41 at our operations.

To advance the goal of Zero Harm in Safety, all our units undertook a comprehensive programme of safety measures to improve workplace conditions in terms of site infrastructure, safety systems and safety culture. Noteworthy infrastructural improvements include safer access pathways for pedestrians to isolate them from vehicles across the sites. Safety systems like introduction of Driver Management Centre, monitoring of vehicle design and condition, and safe driving parameters through smart cameras, speed detectors and GPS-enabled Vehicle Tracking Systems. External third-party training has been provided to 4,000 workers in hazardous process training. Further, we have developed the Enablon portal for timely identification and reporting of safety hazards and rectification of the same.

All sites are committed to ‘Refuse Work if it is Unsafe to Execute’ and empowered all site personnel to reject any activity that posed a possible safety concern.

For Occupational Health, our units celebrate Sankalp Day every month with different themes. Various health awareness campaigns have also been conducted, such as the "Beat the Heat" campaign during summers, Pinkathon for breast cancer awareness, non-invasive anaemia detection camps, mass diabetic screening camps, and neglected tropical disease campaigns. Additionally, three mandatory trainings (Occupational Health and Industrial Hygiene, Ergonomics, and CPR) are provided each month.

During the reporting period, Jharsuguda recycled 17% of their water used, while BALCO and Lanjigarh recycled 13% and 50% respectively. Our specific water consumption at Jharsuguda was 0.20 m3/t, BALCO was 0.53 m3/t and Lanjigarh specific water consumption was 2.09 m3/t.

In line with Vedanta’s de-carbonisation plan, we have undertaken trials at Lanjigarh to co-fire biomass in the boiler, with all defined safety measures, to reduce GHG emissions of the power plant. Furthermore, Jharsuguda has deployed 27 Electric forklifts while BALCO and Lanjigarh have deployed 6 and 3 forklifts respectively, we have planned to shift to 100% EV light motor vehicles by FY 2029-30.

Under our Green product initiative, this year we produced 44 kt of Green Aluminium under the Restora brand name with an immediate potential to produce up to 100 KTPA. Further, our Restora Ultra brand, produced from Aluminium dross generated from the operations, has one of the lowest carbon footprints available on the market today.

In FY 2023-24, we reduced our GHG emission intensity by 2% compared to the FY 2022-23 baseline. We have purchased 1,013 MU of Green Power and co-fired 13,811 tonnes of Biomass.

Management of hazardous waste such as spent pot lining (SPL), aluminium dross, and high-volume low-toxicity waste such as fly ash and red mud are material waste management issues facing the aluminium industry. During the reporting period, our operations have utilised 103% of Ash and 98% of Dross.

Vedanta Aluminium has entered into a long-term partnership with Dalmia Cements for gainful utilisation of industrial by-products such as fly-ash and SPL waste to manufacture ‘green’ cement. This partnership demonstrates our commitment to promote the circular economy and create ‘wealth from waste’. BALCO is engaged in back filling of fly ash into coal mines which further supports our efforts for sustainable management of ash from our operations and achieve our ‘Zero Waste to Landfill’ objective.

Our R&D team, in collaboration with IIT Kharagpur, has developed and patented a new technology for pre-processing of bauxite prior to introduction to the Beyer circuit, which will reduce red mud generation by about 30%. This will also further enhance alumina recovery and broaden range of acceptable bauxite specifications.

At Lanjigarh, calcined alumina production stands at 1.81 million tonnes, up 1% Y-O-Y.

Achieved highest ever cast metal production of 2.37 million tonnes in FY 2023-24, up 3% Y-O-Y, primarily due to improved operational efficiency.

We continue to focus on the long-term security of coal supply to our thermal power plants at competitive prices. We have plans in place to operationalise our captive coal blocks of Radhikapur (West) (6 MTPA) and Kuraloi (A) North (8 MTPA) in FY 2024-25 and Ghogharpalli (20 mt) in FY 2025-26. The Barra coal block is currently under exploration. These captive mines along with 16.7 million tonnes of long-term linkage will ensure 100% coal security for our Aluminium business. We also intend to continue our participation in linkage coal auctions to secure additional coal at competitive rates.

In FY 2023-24, the aluminium market continued the downward trend experienced in the fourth quarter of FY 2022-23 with LME prices falling steadily to US$ 2,100/tonne at the end of June 2023. The market was significantly impacted by volatility in macroeconomic environment during the reporting period amidst the ongoing Russia-Ukraine war, European energy crisis, and high inflation in the key markets. Prices remained range‑bound at these levels through until late in the calendar year where concerns about potential sanctions on Russian metal caused a short-lived spike in prices, before returning to US$ 2,200/tonne at the close.

Total global aluminium demand is expected to increase at a CAGR of ~3% for the rest of this decade. Higher growth rate is driven by the decarbonisation transition in transportation, deployment of renewable power generation, infrastructure development and growth in recyclable packaging. Specifically, aluminium consumption from the renewable energy and electric vehicle sectors is expected to increase to 16 million tonnes by CY 2030.

The transportation sector should support modest growth in domestic consumption, while the building & construction sector will continue a downtrend trend. For the Rest of World, CY 2024 is expected to witness modest demand improvements as inflation rates start to decline and monetary authorities around the world can start to reduce interest rates. Indian domestic aluminium demand will remain very robust driven by key consuming segments like electronics and appliances as well as anticipated boom in renewable, defence, and aerospace sectors.

Cost of production (COP) of alumina for the year was US$ 325 per tonne, down 11% Y-O-Y, majorly driven by softening of caustic soda and coal prices.

Cost of production (COP) of hot metal was US$ 1,796 per tonne down 23% Y-O-Y, primarily on account of improvement in asset reliability and reduction in coal and CP coke prices.

Revenue for the year was ₹ 48,371 crore, down by 8%, due to slip in LME prices partially offset by increase in volume. EBITDA for the year was ₹ 9,657 crore, up by 67% to majorly driven by softening of input commodity prices along with the improved operational performance partly offset by lower LME prices.

BALCO is poised to add smelter capacity of 0.4 MTPA (to achieve 1 MTPA total capacity) with first metal planned by end of third quarter of FY 2024-25. Efforts continue towards achieving higher operational performance along with increased volume delivery through debottlenecking and planning for future growth projects.

The Lanjigarh expansion activities are in full swing, and we achieved our first alumina production from Train-1 in March 2024 and efforts are in place to get first alumina production from Train-2 by end of second quarter of FY 2024-25.

Activities are underway to finalise approvals, acquire land, and instal necessary processing and logistics infrastructure at Sijimali Bauxite Mines to enable us to secure first production by second quarter of FY 2024-25. The future ramp‑up will be instrumental in enabling us to meet the requirement for 5 MTPA refinery operations from captive domestic sources. Operationalisation of our captive coal mines in the short to medium-term and improved linkage materialisation will ease our dependence on relatively higher‑cost spot market coal.

Jharsuguda and BALCO are currently expanding their VAP capacity from 1.1 MTPA to 1.6 MTPA and 0.4 MTPA to 1.0 MTPA respectively to secure enhanced product margins.

Other business priorities include:

Safety and well-being of all our stakeholders, reduction of our carbon footprint and increased production of Low Carbon Green Aluminium (Restora, Restora Ultra), increased Diversity of our Workforce, and promoting the Circular Economy.

Continual improvement in operational parameters.

Achieving >100% capacity utilisation of assets through implementation of our structured reliability and asset management programme.

Zero product defects and customer complaints.

Improve VAP portfolio with focus on anticipating and meeting the needs of sophisticated customers to enable better price realisation.

Vedanta Power is on the brink of significant expansion and operation of two new thermal power projects—Meenakshi (1,000 MW) in Andhra Pradesh and Athena (1,200 MW) in Chhattisgarh. These ventures are slated to commence operations in FY 2024-25 and FY 2025-26 respectively. This expansion will bolster Vedanta Power's total capacity to 4,780 MW, encompassing its existing operational plants Talwandi Sabo Private Limited (1,980 MW) in Punjab and Jharsuguda IPP (600 MW) in Odisha.

This strategic initiative not only amplifies Vedanta Power's operational capabilities but also positions the Company for sustained growth. The integration of these capacities is expected to contribute to stable and substantial cash flows, ensuring a robust balance sheet and sustained margin stability for the business.

In FY 2023-24, TSPL’s (Talwandi Sabo Power Limited) plant availability was 82% and Plant Load Factor (PLF) was 64%.

Overall power sales

In line with group philosophy, TSPL is also a part of “VIHAN-Every Step Safe Step” which is a unique safety initiative which focusses on developing Infra-matrix for each type of critical risk. In FY 2023-24, TSPL focussed on Category 5 Safety Incident elimination through Critical Risk Management, Catastrophic Risk Management, Horizontal Deployment of Safety Alert Learnings,, Vedanta Safety Standard Implementation and Engineering / Controls such as Hand Injury Prevention and Green hand policies.

We continue to strengthen ‘Visible Felt Leadership’ through on-ground presence of senior management, improvement in reporting across all risk and verification of on-ground critical controls. We also continue to build safety capability building assisting infrastructure and procedure development for fire-man endurance test, lifting tools and Tackles testing bench, apart from regular development through expansion of Bulker parking, finalisation of road map for ITMS etc.

TSPL focusses on environment protection measures such as maintaining green cover of over 800 acres, continue the expansion of green cover inside plant premises and nearby communities. TSPL ensures availability of environment protection system such as ESP, Fabric Filters, water treatment plant and RO Plant. In Tailing Dam Management, TSPL has implemented all the recommendations of M/s Golder associates for ash dyke. Additional GISTM Conformance Assessment of TSPL Ash Dyke Facility by ATC Williams, Australia and TATA Consultancy (TCE) as Engineer of Records (EOR) to ensure Ash Dyke stability to review dyke design, quality assurance during for ash dyke raising and quarterly audit of ash dyke facility. In FY 2023-24, TSPL achieved 100% Ash utilisation in Road Construction, in building sector for bricks, blocks, cements and low-lying area filling. TSPL has signed various MoUs with stakeholders to increase ash utilisation.

TSPL has recycled 19% of the water used and reduced fresh water consumption by various operation controls. TSPL continues its focus on energy saving projects such as CEP VFD rpm reduction, condenser vacuum improvement, HP heaters performance improvement, APH basket and seal replacement, high energy drain valve replacement and rectification, replacement of conventional lighting fixtures with LED lighting fixtures.

To stimulate efforts and reach towards new heights of sustainable business practices, TSPL continued with ESG transformation office. TSPL ESG Transformation Office was created which includes 13 communities of practice from each aspect of sustainability like Carbon, Water, Waste, Biodiversity, Supply chain, People, Communities (CSR), communication, Safety and Health, Acquisitions, Expansions and Finance. Each Community is led by a senior leader in the concerned department. Each community is driving sustainability initiatives in their community which is being reviewed by Senior management on regular basis through ESG-TO engagement. In FY 2023‑24, 124 new projects were identified, 53 initiatives were completed, and 71 improvement initiatives are in progress. In FY 2023-24, TSPL has reduced Specific GHG emissions to 3% & has achieved a reduced Specific water consumption to 11%. In this year TSPL along with district administration has developed 3 Miyawaki forest covering 0.125 acres land in the district of Mansa.

Power sales for the year was 13,443 million units, down by 5% Y-O-Y. Power sales at TSPL were 10,278 million units with 82% availability in FY 2023-24. At TSPL, the Power Purchase Agreement with the Punjab State Electricity Board compensates us based on the availability of the plant.

At Jharsuguda, the 600 MW power plant operated at a lower plant load factor (PLF) of 58% in FY 2023-24 due to temporary ash evacuation constraints.

Average power sale price for the year was ₹ 2.82 per kWh excluding TSPL, down by 4% and the average generation cost was ₹ 2.57 per kWh, up by 9%.

TSPL’s average sales price was ₹ per 4.10 kWh, down by 9% at, and power generation cost was ₹ 3.26 per kWh, down by 11% Y-O-Y.

Revenue for the year was ₹ 6,153 crore, down by 8%. EBITDA for the year was ₹ 971 crore, up by 6%.

During FY 2024-25, we will remain focussed on maintaining the plant availability of TSPL and achieving higher plant load factors at Jharsuguda IPPs.

Our focus and priorities will be to:

Sesa Goa is one of the largest private sector exporters of iron ore in India. During FY 2023-24, Operationalised Bicholim mine in Goa (3 MTPA capacity), marking the commencement of first mining operation in the region after six years. Also, WCL made its first shipment in freight friendly market earning a higher margin.

In Coke business, Prime Hard coal consumption was reduced to 20% in FY 2023-24 from 35% in FY 2022-23 in overall coal blend.

Highest ever saleable ore production at Karnataka

With our vision towards the aim of Zero Harm, we are committed to achieving zero fatal accident at Iron ore Business. Our Lost Time Injury Frequency Rate (“LTIFR") is 0.89 compared to 0.79 in previous year. Currently, we are focussing on bringing down the number of injuries by conducting a detailed review of critical risk controls through critical task audits, strengthening our work permit and isolation system through identification and closure of gaps, on-site audits, increasing awareness of both Company and business partner personnel by conducting trainings as per requirements considering the sustainability framework.

We have strived to enhance the health and safety performance by digitalisation initiatives such as usage of non-contact type voltage detectors, underground cable detectors. We have also implemented AI cameras (T-Pulse system) for reporting of unsafe acts/conditions. Our prime focus is on elimination, substitution, and Engineering Controls to reduce workplace-related hazards.

Vedanta has launched a HSE-based portal by name V‑Unified (Enablon) for reporting, collating, and analysing the HSE related data across the Business which has become a way of life since its inception during the Financial Year.

At Sesa Goa, we have rolled out Critical Risk Management (CRM) modules to improve our safety culture and bringing down our injury rates. All the observations are being tracked, analysed, and rectified by preparing global action plans. We have achieved more than 95% actual verifications vs our planned verifications. We have implemented Monthly theme of the month campaigns for implementation of Vedanta Safety Standards at shop floor level and creating awareness among all the employees and business partners.

In Health function, we have also launched SEVAMOB digital platform for digitisation of Employee Medical Records which help us in tracking and giving health-related trend analysis of employees.

We have rolled out Safety Governance structure and Safety score card system for all SBUs of IOB. Through Safety Governance structure, senior line function leaders are driving safety management system for their SBUs.

In order to achieve highest levels of safety at site, we have identified key personnel from operation and maintenance to serve as Grid Owners in addition to their current roles and responsibilities. Specialised safety trainings like defensive driving, work at height, confined space, crane lifts, etc. are provided to concerned employees based on their job role.

At Sesa Goa, we strive towards zero harm to environment. We work on the principle of Reduce, Recycle and Reuse across business. We harvest rainwater at all our operational sites and are water positive. We also adopt best practices in mine reclamation and Sanquelim mine reclamation is a testament to the same. We have planted 66,000+ native species plants across SBUs in this year.

Value-Added Business also improved its air pollution control devices by replacing the old bag houses by new efficient baghouses.

At Iron ore Karnataka, continuing with its best practices, Company has constructed 38 check dams, 7 settling ponds. Additionally, Company has de-silted 2 nearby village ponds increasing their rainwater harvesting potential by 20,000 m3/annum.

To abide by our net zero target by 2050, Sesa Goa is the first Company to take the trial of EV wheel loaders in open cast mines at IOK and is determined to convert the existing fleet to EV. Vedanta SESA Goa has taken a step forward to promote sustainable transport by installing the first ever free EV fast charging station at Amona, VAB. This charging station will allow all the employees, business partners and people from the community to adopt sustainable transport. Vedanta Sesa Goa is actively advocating for the broader adoption of biodiesel, across its diverse business units.

IOK successfully hosted MEMC Week in FY 2023-24 and bagged 8 awards during the event

At Karnataka, highest ever annual saleable production of 5.6 million tonnes in FY 2023-24, up by 5% Y-O-Y due to operational efficiency and process improvement. We recorded highest ever annual sales of 5.9 million tonnes in FY 2023-24, up by 19% Y-O-Y due to improvement in logistics efficiency, which in turn helped to liquidate the inventory level. We achieved highest ever annual production of pig iron of 831 kt in FY 2023-24, up by 19% Y-O-Y driven by improvement in process efficiency and FY 2022-23 production was impacted due to shut down in one of the smaller blast furnaces. Also, we achieved highest ever annual sales of 836 kt, up by 23% Y-O-Y driven by improvement in operational & logistics efficiency.

At Goa, we bought iron ore in auctions held by Goa Government in FY 2023-24 which was then beneficiated. Around 0.3 million tonnes were exported and some ore were consumed to cater to requirement of our pig iron plant at Amona.

For Bicholim mines, EC for 3 MTPA was granted in January 2024 and operations were seamlessly restarted in end of March 2024 within 15 months of its acquisition.

Revenue for the year was ₹ 9,069 crore, up by 39% Y-O-Y mainly due to higher volume at Karnataka and VAB. EBITDA for the year was ₹ 1,676 crore, up by 70% Y-O-Y majorly due to increase in sales at Karnataka and VAB and softening of coking coal prices.

Our near-term priorities comprise:

ESL Steel Limited or ESL is an integrated steel plant situated in Bokaro, Jharkhand, with a design hot metal capacity of 3.5 MTPA. Its current operating hot metal capacity is 1.5 MTPA with a diversified product portfolio of Wire Rod, Rebar, DI Pipe and Pig Iron which are sold across key sectors such as construction, infrastructure, transportation and energy.

In line with debottlenecking and improved operational efficiency, ESL achieved highest ever hot metal production of 1.47 million tonnes up 8% Y-O-Y and highest ever saleable production of 1.4 million tonnes up 8% Y-O-Y.

Highest-ever crude steel production

Safety is a paramount focus for ESL, ingrained in every facet of our operations. We prioritise the well-being of our employees, business partners, and the communities we serve primarily. Through rigorous training programmes, stringent safety protocols, and continuous monitoring, we ensure that safety remains at the forefront of every task, from the shop floor to the boardroom. Our commitment to safety extends beyond compliance with regulations; it is a core value that guides our decision-making and shapes our culture. By fostering a safety-conscious environment, we not only protect lives and assets but also cultivate trust, loyalty, and long-term success.

Few specific projects which have improved safety culture in our organisation:

We have a robust transformation office and governance structure including 12 Community of Practices which is spearheaded by CEO and senior leadership. Identified 97 projects under various COPs and 27 projects have been completed and 30 project are in final stage.

Production of saleable product for the year was 1,386 kt, up by 8% Y-O-Y in line with increased hot metal due to debottlenecking of blast furnace and operational efficiencies.

Softening of costs in raw materials such as coking coal, coupled with various market dynamics, led to a decrease in the cost of sales while sales and market prices remained under pressure.

In FY 2023-24, our captive mines at Barbil produced 5.4 million tonnes and dispatches were 5 million tonnes, ensuring iron ore raw material security.

Our priority remains to enhance production of value added products viz. Rebar, Wire Rod and DI Pipe and hence margins.

Regarding renewal of Consent to Operate (CTO) for the steel plant at Bokaro, Ministry of Environment, Forests and Climate Change (MoEF&CC) has issued a letter to forest department of Jharkhand to submit the complete compliance of the condition for further consideration. State has submitted the Compliance Report vide letter dated 17 November 2023 citing the progress and requesting to reconsider the FC Stage I revocation. Further updated letter is expected from the State by MOEF&CC with respect to the status.

For detailed information, Click here

Average sales realisation for the year was US$ 610 down by 11% Y-O-Y. Prices of iron and steel are influenced by several macro-economic factors. These include global economic scenarios, wars, duties on iron and steel products, supply chain destocking, Government expenditure on infrastructure, the emphasis on developmental projects, demand-supply dynamics, the Purchasing Managers’ Index (PMI) in India and production and inventory levels across the globe especially China.

Cost for the year was US$ 588 per tonne, down by 10% Y-O-Y primarily on account of decrease in coking coal prices during the reporting period, and other operational efficiencies which is partly offset higher bid premium paid on captive iron ore mines dispatches.

Revenue for the year was ₹ 8,300 crore, up by 6% Y-O-Y, primarily due to higher volume which is getting offset due to lower realisation. EBITDA was ₹ 225 crore, down by 29% Y-O-Y.

Steel demand is expected to be robust in India, buoyed by strong demand from key sectors (construction and housing, automobiles, power projects) and Government’s push to ramp-up infrastructure spend in India. Hence, we prioritise to increase our hot metal production capacity from 1.7 MTPA to 3.5 MTPA by FY 2024-25 with a vision to become high-grade and low-cost steel producer with highest Environment, Health, and Safety standards.

The focus areas comprise:

Ferro Alloys Corporation Limited or FACOR has a strong presence in the business of producing Ferro Alloys and owns a Ferro Chrome plant with capacity of 145 KTPA one operational Chrome mines and 100 MW of captive power plant.

In FY 2023-24, Ferrochrome ore production was 240 kt which is down by 17% Y-O-Y on account of statutory clearances for Kalarangiatta Mine. Ferro Chrome production was 80 kt up 18% up Y-O-Y being highest ever production since acquisition.

Record saleable production

At Mining division, ROM production from Ostapal Mine achieved 100% of EC limit, i.e. 240 kt and EC for enhanced production of 1.5 million tonnes per annum is in pipeline, and for that public hearing has been conducted successfully in December 2023. Production at Kalarangiatta mine has been temporarily halted due to statutory clearance issue, but full fledged production will commence again in FY 2024-25.

At Charge Chrome Plant (CCP) we recorded Ferrochrome metal volume of 80 kt in FY 2023-24. We have recorded highest ever monthly ferro chrome production of 8,907 mt in January 2024. We have reduced our specific ore consumption to 2.31 mt/mt against 2.40 mt/mt. Current year specific coke consumption is 560 Kg/mt against 591 Kg/mt last year.

At Power Plant, we recorded annual Power Generation of 291 MU in FY 2023-24.

Revenue for the year was ₹ 809 crore, up by 5% Y-O-Y, primarily due to higher sales volume partially offset by lower realisation. EBITDA for the year was ₹ 115 crore, down by 23% mainly due to higher cost of production because of purchase of ore from external sources and statutory clearance pending for Kalarangiatta Mines.

Silvassa operations continued to deliver 21% growth in sales volume on Y-O-Y basis and significant portion of which is catered to India’s domestic copper market.

The copper smelter plant at Tuticorin was under shutdown for the whole of FY 2023-24. On 29 February 2024, the Supreme Court dismissed the Special Leave Petitions filed by the Company towards plant restart. The Company is evaluating legal remedies for sustainable restart of Tuticorin plant.

Growth in sales volume

The lost time injury frequency rate (LTIFR) was 0.39 in FY 2023-24 (FY 2023-23: 2.77). This year witnessed adoption of new technologies to enhance the workplace safety. Artificial Intelligence based camera system were installed for continuous monitoring of the workplace to detect any unsafe acts/conditions in the critical work areas. Initiated projects such as Air-Cooled helmets for employees working in hot work areas and fatigue monitoring devices for forklift drivers. Critical Risk Management (CRM). The safe work culture was promoted by the safety leadership with constant interaction with business partners and other stakeholders through trainings, campaigns, leadership walkthrough programmes, stand downs, committee meetings and R&R programmes.

The Silvassa copper operation was awarded with the British Safety Council – International Safety Award in the Merit Category as a testimony to our commitment of maintaining safe and healthy workplace.

Aligned with the Vedanta’s vision to reach net zero emissions by 2050, Sterlite Copper has signed contract with M/s Serentica Renewable Power Limited for the supply of 16 MW with a potential to offset 64,535 tCO2e per annum. Further, consumption of secondary copper in the process has seen significant reduction of approx. 39,000+ tCO2e compared to primary sources. The Company has been constantly striving to achieve efficiency in terms of power consumption in process vis-à-vis – installation of IE4 motors phasing out lesser efficient motors. Emission reduction programmes in pipeline include implementation of E-Forklift and announcement of E-Vehicle Incentive programme for all eligible employees.

Copper business has launched "CuBert", the first AI chatbot in Base Metal Industry, to transform Customer Experience (CX) through digital innovation. CuBert enhances customer engagement with features like real-time order tracking, live LME & Forex rates, and access to booking details, quality certificates, ledger statements, and many more. By integrating real-time data and personalised interactions, CuBert has significantly improved user satisfaction and set a new industry standard in customer service.

Copper production in Silvassa reduced by 5% to 141 kt owing to global copper blister shortage. However, sales have witnessed growth of 21% in terms of sales volume and realised highest sales after closure of the Tuticorin unit and improved operational efficiencies, debottlenecking and capability building initiatives carried across the plant, the year also marked remarkable growth in free cash flow.

In the matter of restart of Tuticorin operations, the Supreme Court has dismissed Special Leave Petitions filed by the Company and refused to grant it permission to reopen Tuticorin smelting operations. The Company is evaluating legal remedies for sustainable restart of Tuticorin plant.

For detailed information, click here

Average LME copper prices reduced by 2% compared with FY 2022-23 predominantly due to lower than expected demand in China & Higher US Fed Interest rates.

Revenue for the year was ₹ 19,730 crore, up by 13%. The increase in revenue was mainly due to higher volume, favourable exchange rate partially offset by lower Copper LME prices. EBITDA for the year was ₹ (69) crore, mainly on account of supply shocks from global blister shortage.

Over the following year, our focus and priorities will be to:

We believe every incident can be prevented.

The lost time injury frequency rate (LTIFR) is 6.92 in FY 2023-24 vis-à-vis 2.91 in FY 2022-23. To improve safety at workplace, we promote felt leadership culture with involvement of senior leaders for strengthening our safety system.

Safety stand-downs were conducted to communicate the learnings from safety incidents across the group. Our safety leadership regularly engages with the on-ground team to improve behaviour-based safety culture.

With the view of rising Nickel demand due to upsurge in the EV battery markets, outlook of the global Nickel demand is very much positive. We have planned on enhancing the plant capacity production in following two phases: