Management Discussion and Analysis

Segment Review

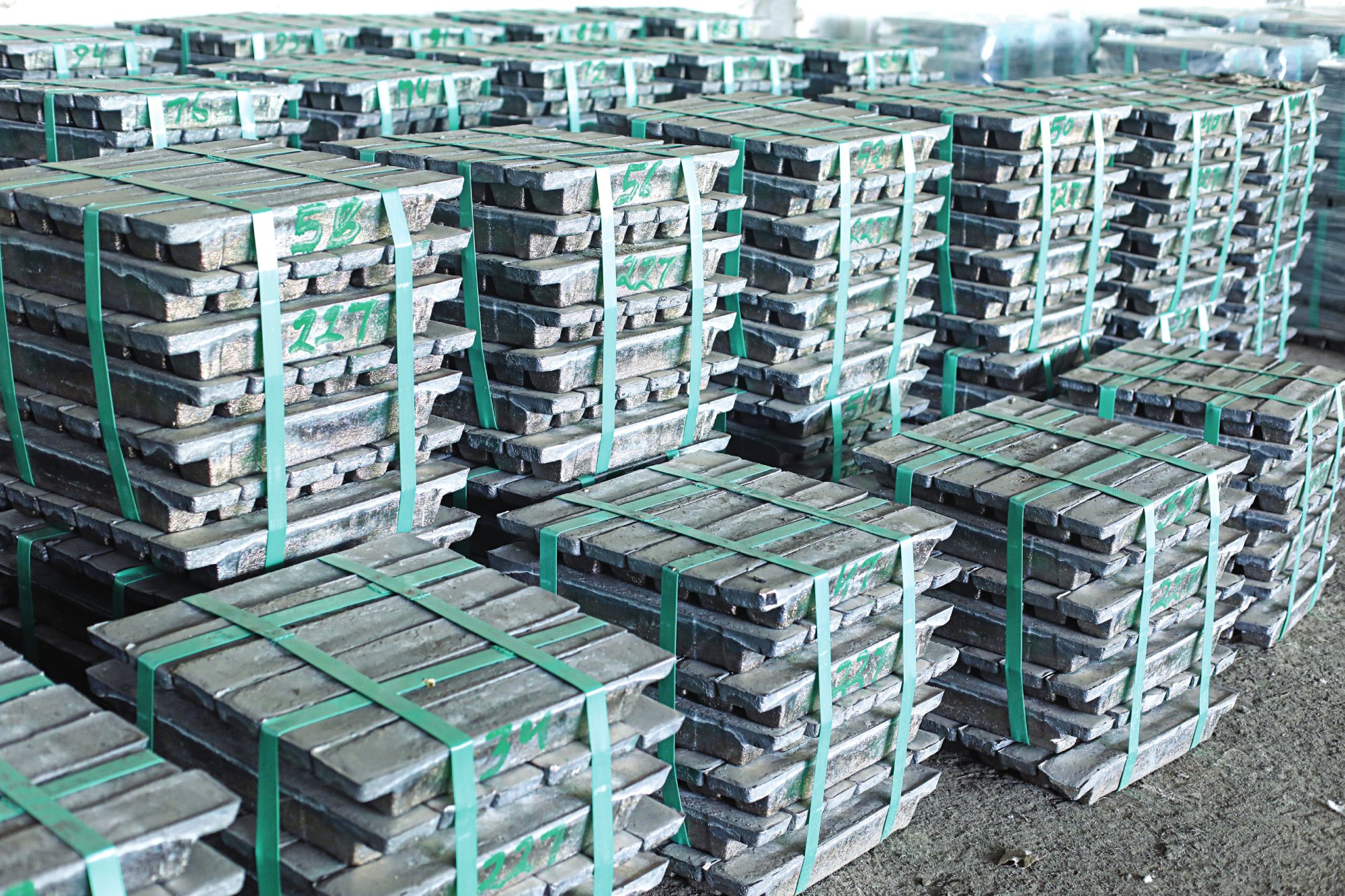

Zinc

Overview

Inflation worries, the US Federal Reserve’s change of stance, strengthening of the dollar and expected sale of metals by China led to declining zinc prices in Q2FY2022. The zinc market, in any case, had been bracing itself for smelter production disruption since October 2021. Even though there is still no real evidence of sizeable smelter cutbacks, premiums for spot refined metal in all regions have increased while annual contract premium offers in Europe and the US for 2022 have doubled.

Supply chain constraints induced by the pandemic are likely to remain and, as previously, cause delay in meeting the pent-up demand for zinc-intensive manufactured goods. The manufacturing sector, meanwhile, has been recovering fast. Although the manufacturing PMI for the Eurozone is less than its peak recording in June 2021, the region has registered strong sectoral growth.

In India, both the manufacturing sector and services sector have seen robust improvement although hopes of increasing output levels have been tempered by inflationary pressures. Given the government push for infrastructure, highways, electrification and transmission projects, the structural sector will create major demand for zinc.

Market drivers

Despite a downward revision in global zinc consumption forecast for 2022, global zinc consumption is expected to grow by 1.3% to 14.3 mt, and eventually to 14.5 mt in 2024. Notwithstanding the global demand downgrade, the refined market is expected to remain tight. Global refined stocks are forecast to fall from the equivalent of 44 days of consumption at the end of 2021 to 35 days by the end of 2022 and remain close to this level till 2025. Such low stocks should support elevated zinc prices at annual averages of US$3,734/t, US$3,525/t and US$3,400/t (Source: Woodmac) respectively

While possible disruptions to smelter production remain an upside risk to this outlook, it is likely to be offset, at least in part, by disruption to first and end use demand in Europe and potentially elsewhere in the world.

Products and customers

Hindustan Zinc Limited (HZL) is the largest primary zinc producer in India, with an expected 80% market share in 2022. Around 65% of the refined zinc produced by HZL’s smelters is sold in the domestic market, and the rest is exported to Southeast Asian and Middle Eastern markets. Over 70% of the Indian zinc demand comes from galvanising steel, predominantly used in the construction and infrastructure sectors. HZL also produces Continuous Galvanising Grade (CGG), EPG (Electro Platting Grade) and two grades of zinc for use in die-casting alloys. The company is working closely with its customers to increase the proportion of value-added products (VAP) in its zinc portfolio. It will strive to increase the supply of VAP to 24% of total zinc sales in FY2023, from 20% in FY2022.

Hindustan Zinc Limited (HZL) is the largest primary zinc producer in India, with an expected 80% market share in 2022.

Lead

Overview

For base metals, sentiment turned bullish following signs of economic improvement. However, a strengthened dollar and apprehension of inflation in the US pushed down base metal prices. Global lead demand fell -3.4% in 2020 compared to 2019, but has picked up since, averaging 2.2% pa in the medium term and 2.0% pa over the long term to our forecast horizon of 2040. While this is lower than the 2.6% pa average over the decade from 2010, it should still be regarded as a positive outlook. In 2022, we forecast 12.9 mt of refined lead consumption, increasing to 15 mt in 2030 and 18.4 mt in 2040.

Market drivers

Construction for a new lead battery production facility has started in Dubai (UAE), including a secondary lead smelter. Once completed in 2023, the plant can recycle 25 kt of scrap batteries per annum, producing 14 kt of refined lead for its battery production.

The Chinese and Indian automotive sectors will be the main drivers of global demand growth, along with other Asian countries. Changes in the high lead-consuming but developed regions of North America, Europe and Japan will be minimal over this period, with stable vehicle populations and increasing levels of finished battery imports from regions of lower production costs, such as Asia. Automotive replacement batteries will be the key demand drivers, growing over the medium term between 2021-2025 at 2.8% pa. The increase in original equipment (OE) batteries is a more modest 1.7% pa. With a weakened economic outlook for this period, and people’s tendency to retain their existing vehicles for longer, the balance will tip in favour of replacement batteries over OE.

Ukraine, which produces many key components for the European auto industry, is likely to see disruption in production. Given that it is also a major producer of inert gases used in semiconductor production, problems are likely to deepen for the sector. Thus, a wider European and global economic impact of the Ukraine-Russia conflict will lower demand for new vehicles in 2022 and beyond.

Products and customers

India’s refined lead market, including both primary and secondary markets, is about 1.1 mt. The primary lead market, approximately 280 kt in size, remained stagnant in 2021. We expect to close at the same rate; about 87% of our production will be consumed by the domestic market and the rest will be exported to the Southeast Asian market. Next year, we are expecting to increase our sales by 3-4% through new customer acquisition, enabled by our e-commerce platform (Evolve), and the introduction of lead alloys in our product portfolio.

Silver

Overview

Silver Institute predicts global demand to rise by 8% from 2021 to a record high of 1.112 billion ounces in 2022. The rise will be driven by record silver industrial fabrication, as consumption increases in traditional and green technologies. Investment demand for physical silver bar and bullion coins is expected to jump by 13% in 2022 to a seven-year high. Demand for silver for jewellery is expected to rise by 11% and for silverware by 21%.

As governments around the world increasingly commit to carbon emissions reduction, silver demand for solar photovoltaic panels will reach an all-time high. With increasing vehicle electrification and the acceleration of 5G network infrastructure, demand from the automotive and 5G telecom sectors can be expected to remain strong.

The silver market in India saw extreme volatility in Q3FY2022, swinging between the extremes of US$21.8 to US$25.2 per troy ounce. The rise in price was anticipated, given the festive demand, especially in the Indian subcontinent and the Gulf region. Imports, which began in Q2FY2022, gained momentum with more than 54 mt of silver being imported in October 2021 alone. With silver mines now operational worldwide, higher production has resulted in higher import sales in the domestic market.

Market drivers

The Silver Institute has projected total supply to rise by 7% to 1.092 billion ounces in 2022, with mine production ramping up to a six-year high. Primary silver mines are expected to increase output from large sites and new projects. The silver market fell into a deficit in 2021 for the first time in six years, which is expected to continue in 2022 with a shortfall of 20 million ounces, which is believed to be relatively modest in absolute terms.

Products and customers

Hindustan Zinc (HZL) is India’s only primary silver producer and ranks 6th globally among the top silver producing companies. Exclusively catering to the domestic market, HZL’s production finds use in industry (electrical contacts, solder and alloys, and pharmaceuticals), jewellery and silverware. Last year, the company started spot sales of silver through an e-auction to reduce manual intervention. This also provided buyers equal opportunity to compete, while ensuring complete price transparency.

Aluminium

Overview

FY2022 mostly saw a deficit in the global primary aluminium market, and the trend is expected to continue in the next fiscal. During the autumn of 2021 (Q2 and Q3FY2022), energy prices skyrocketed due to COVIDinduced closure of coal mines in Australia, higher Indonesian coal demand from China and geopolitical instability in Africa and Eastern Europe, together with an exceptionally high demand for oil. This resulted in the closure of several European smelters, which pushed aluminium prices around the world to a record high. FY2022 also witnessed demand growth stabilisation around the world to pre-COVID levels. During the year, India’s primary aluminium demand grew at an average of 14%. However, overall export sales of aluminium grew by 6% during FY2022.

Market drivers

India has witnessed impressive economic recovery postlockdown of 2021. With continued structural support from the government through various schemes focusing on infrastructure and manufacturing, demand and industrial activity are expected to witness stellar growth. Aatmanirbhar Bharat, ‘Make in India’, the PLI scheme for domestic manufacturing, the National Infrastructure Pipeline and National Rail Plan of the Government of India will help increase the demand for metal in the market. Taking these macro drivers into cognisance, Vedanta continues to expand its value-added product portfolio in line with the evolving market demand.

Products and customers

With an annual production capacity of ~2.2 mt, Vedanta is India’s largest primary aluminium producer. It leads the primary product segment with a domestic market share of ~47% among the primary producers in India.

Our product portfolio includes aluminium ingots, primary foundry alloys, wire rods, billets, and rolled products. These products cater to varied industries globally such as power, transportation, construction and packaging, to name a few. As much as 39% of Vedanta’s total aluminium sales globally are high quality value-added products.

Our major focus area is the domestic market. In FY2022, domestic sales volume was similar to that of last year. Value-added products accounted for ~66% of domestic sales. Major growth was registered in the international markets, where sales volume increased by ~23% y-o-y to 1.66 mt, while overall sales volume increased by 14%.

We have a large OEM base throughout the world for consumption of our value-added products. Europe and North America have the largest share in overall export sales.

Power

Overview

India is the third largest producer and second largest consumer of electricity in the world with an installed capacity of 399 GW as on March 2022 and an estimated power consumption of 1894.7 TWh in 2022. For FY2022, the electricity generation target from conventional sources has been fixed at 1,356 billion units (BU), higher by 9.83% y-o-y. Between FY2016 and FY2021, the country’s electricity generation grew at 1% CAGR, driven by government initiatives and schemes to increase rural electrification and provide round-the-clock power supply.

Market drivers

India’s power demand is likely to touch 1,894.7 TWh by FY2022, driven by multiple factors such as expansion in industrial activities, growing population, rising per capita income, policy support and increasing electricity penetration.

The Government of India and state governments have also been supportive of growth of the power sector through various reforms, such as delicensing the electrical machinery industry and allowing 100% Foreign Direct Investment (FDI). In addition, policy support (Saubhagya, Integrated Power Development Scheme, DeenDayal Upadhyaya Gram Jyoti Yojana or DDUGJY, Unnat Jyoti by Affordable LEDs for All or UJALA, Restructured Accelerated Power Development and Reforms Programme or R-APDRP, Ujwal DISCOM Assurance Yojana or UDAY, National Infrastructure Pipeline or NIP, and many others) have provided the much-needed impetus to the sector. The country’s power sector is likely to attract an investment of US$128.24 billion to US$135.37 billion between FY2019 and FY2023.

Energy sector projects accounted for the highest share (24%) in the US$1.4 trillion NIP between 2019-25. The Government of India has opened the coal sector for commercial mining, which is expected to ease coal availability.

Products and customers

Vedanta’s Power business operates over 9 GW power portfolio in India. Of its portfolio in aluminium business, ~16% is used for commercial power while ~84% is meant for captive use. The power generated for commercial purposes is backed by long-term Power Purchase Agreements (PPAs) with state distribution companies such as Tamil Nadu, Kerala, Chhattisgarh, and Odisha.

Oil and gas

Overview

The year 2021, which saw marked global economic recovery, also witnessed relative stability in the Oil & Gas market. Vaccination efforts and limited lockdowns boosted demand, and this was supported by rising mobility and travelling activities.

Global oil supply increased by 1.6 Mbpd to 95.4 Mbpd in 2021, with OPEC countries increasing their production and the US, Russia, Saudi Arabia, and Iraq contributing to the pool. With an increase of 5.2 mb/d, in 2021, world oil demand substantially outpaced the historical low of 2020, although it remained below pre-pandemic levels. Notwithstanding a dip in Q1FY2022, world oil demand during Q3 and Q4 proved to be substantially more resilient than previously anticipated. Demand growth in non-OECD countries was substantially high at 2.7 mb/d. In the OECD, the US continued to be the major driver of oil demand.

India, the world’s third largest oil consumer and the fourth largest refiner, currently meets 85% of its oil consumption and 50% of its gas consumption through imports.

Market drivers

The year 2022 could be pivotal in the natural gas sector as Russia tries to secure its strategic interests in Ukraine. Given that Europe depends on Russia for most of its crude oil, natural gas, and solid fossil fuel supplies, RussiaUkraine tensions have stirred anxiety within Europe over the potential outcome of financial sanctions imposed on Russia or Nord Stream 2 or the possibility of Russia slashing Europe’s energy supplies or cutting capacity through Ukraine. Many see Germany’s strategic energy partnership with Russia over Nord Stream 2 pipeline as a conflict of interest in diplomatic dealings involving Ukraine.

According to the International Energy Agency, global oil stores were reduced by 600 million barrels in 2021, a 200 million barrel discrepancy from the forecast tally. This difference could lead to a tighter market in 2022. There are apprehensions that the world is hurtling towards an oil supply crisis. There is a possibility that oil prices could be elevated further to about US$140 to US$150, if not higher, to kill discretionary demand.

Oil could also see an uptick in demand as it becomes increasingly used as a substitute for natural gas in heating and electricity generation. The World Bank expects oil prices to average US$74 in 2022, as demand continues to recover to pre-pandemic levels in H2. It also anticipates a steady decline in natural gas prices in 2022 and into 2023 because of shrinking demand growth outside Asia, plus production and export increases. The Bank has also highlighted how events in 2021 show the growing risk from climate change to energy markets, affecting both demand and supply. In perspective of the energy transition, the intermittent nature of renewable energy highlights the need for reliable baseload and backup electricity generation.

Marinchenko and Fitch Ratings see oil prices steadying in the US$70 range based on the expectation that OPEC+ will continue to actively manage supply to avoid large surpluses or deficits in the market.

Products and customers

Vedanta is the largest private sector producer of crude oil in India. Our crude is sold to hydrocarbon refineries and our natural gas is used by the fertiliser industry and the city gas sector in India.

Iron ore

Overview

Iron prices increased globally during FY2022, and Karnataka’s iron ore industry reflected this trend in Q1 FY2022. Demand side improvement together with relaxation in lockdown guidelines, further raised prices in Q2. The next two quarters were subdued, due to weak demand from the steel market. The market reflected developments in China’s steel industry, which in 2021 saw mandatory steel output cuts aimed at reducing the sector’s carbon emissions and weakening demand from the construction sector.

Market drivers

Iron ore prices are expected to remain range-bound going into 2022. Imbalances in demand and supply led to the price rally in the global market in Q1 and Q2. Global supply of iron ore, which was tight in the first half of 2021, continued easing as the year came to an end. The improvement reflected recovery in production and exports from western Australia as the acute weather disruptions seen at the beginning of 2021 dissipated.

In May 2021, the Chinese government announced its aim to diversify its iron ore supply (Australia currently accounts for more than 60% of the nation’s iron ore imports.) The new plan included a target of 45% self-sufficiency in raw materials for steelmaking by 2025; increased domestic exploration and output of iron ore; and securing more overseas reserves.

Although Vale has announced plans to expand its capacity significantly, much of the resulting output is not expected to reach overseas markets for at least two to three years. BHP and Rio Tinto are starting production in new mines in the Pilbara region of western Australia, but much of the resulting output will substitute for depleting mines in the same area. Consequently, overall output growth is not expected to occur at a pace that would reduce prices significantly.

Products and customers

Iron ore, a key ingredient in steelmaking, is used in construction, infrastructure, and automotive sectors. Vedanta’s iron ore mining operations in Goa ceased from March 2018, pursuant to the Supreme Court order. Meanwhile in February 2021, the permitted mining capacity at Karnataka has increased from 4.5 mt in FY2020 to 5.6 mt.

Steel

Overview

Steel is one of India’s core industries, contributing slightly more than 2% to the GDP. India, the second-largest steel producer in the world, manufactured 118.1 mt of steel between January-December in 2021. Crude steel production increased 18% in FY2022 (Apr-Jan), reaching 98.887 mt.

After being impacted by the pandemic and the monsoons in H1FY2022, steel production recovered in H2. H1 however saw substantial rise in exports due to the lowering of domestic demand and better export realisation. Demand picked up in Q4FY2022 as a result of infrastructure projects and increased exports. March 2022 saw a steep increase in prices on the back of increased raw material prices due to the Russia–Ukraine conflict.

Market drivers

Demand in FY2023 is expected to be robust with the government’s push to increase steel production as per the National Steel Policy. The government’s Make in India policy will also support the industry.

Demand from the major sectors such as infrastructure, construction and housing, renewables and automobile is expected to be strong. The Union Budget 2022-23 has announced expansion of the national highway network by 25,000 km in FY2023. There will be increased demand from railways as well, given that 2,000 km of railway network will be brought under ‘Kavach’ in FY2023 as a part of the Aatmanirbhar Bharat policy. The rail budget has also declared 400 Vande Bharat Express trains and 100 cargo terminals with multimodal logistics.

The housing sector is also expected to contribute to the demand, given the government target to set up 80 lakh houses under the Pradhan Mantri Awas Yojana for rural and urban areas. A resurgent automobile sector, which is expected to draw an investment of `74,850 crore as part of the PLI scheme, is likely to boost demand for steel.

In FY2023, steel prices are likely to remain volatile due to high and fluctuating raw material prices and various global factors. Coking coal prices has crossed US$700 CFR, forcing steel companies in India to pass on the cost to customers. The government is reported to have committed to improving the availability of suitable coking coal, which will go a long way in fundamentally strengthening India’s steel industry.

Products and customers

During the year, we developed new products and received blanket approval from the National Highways Authority of India. We also exported our first consignment of DI pipes and will continue to focus on strengthening our exports across various products. The acquisition of two iron ore mines via auction in Odisha during the year is helping Vedanta grow more self-reliant in iron ore supply while facilitating future expansion plans. A major focus will be digitalisation for fair price recovery. For prime grades for all products, we are also considering conduct of sales via auction. The upcoming financial year will see us focus more on retail segments.

Copper

Overview

Year 2022 was another volatile year for copper prices, given rising geopolitical tensions, inflation and energy costs, as well as the impact of the pandemic on labour availability, which affected the market. However, demand in the world ex-China looks set to remain strong this year, which should underpin high prices. There are also supply chain constraints which are impacting manufacturing. Notwithstanding these challenges, copper consumers, both first and end users, appear to be upbeat about the 2022 demand prospects. Despite the resurgence of COVID-19 in China, the country’s plans to hedge against the economic slowdown would render stability to copper demand from the construction and infrastructure sectors.

The major copper smelters in China appear to be sitting on ample concentrate stocks. This may be the reason why the usual flurry of buying activity at the beginning of a new year has not happened. Producers are also content to deliver concentrate into contracts rather than load the market with spot volumes when the demand is soft.

Market drivers

Resurgence of COVID-19 in China has caused several cities to impose lockdown. If the situation persists, it could present a downside risk to our current demand forecast. Total copper consumption in China is projected to grow by 0.7% in 2022, and by 1.1% and 1.7% in 2023 and 2024, respectively.

Research (Source: Woodmac) shows that mine disruptions in 2021 amounted to almost 5%, or 1.1 mt, of the total mine output, 0.84 mt for copper concentrate operations, and 0.22 mt for SxEw operations.

Analysts project a 16% rise in copper demand, which is expected to reach 25.5 mtpa by 2030. This contrasts with the supply forecast, which at 19.1 mtpa will fall well short of the demand. Copper demand from all sectors combined is expected to grow 32% by 2040, compared to that in 2020. This includes demand from solar, onshore/offshore wind, hydroelectric, biomass and nuclear projects. This ‘green’ demand is expected to contribute more than half the incremental increase in 2022. Primary copper use, which reportedly increased by 6.5% y-o-y in 2021 (Source: ING), is expected to see a more moderate increase in 2022.

Products and customers

Refined copper is predominantly used in the manufacture of cables, transformers and motors as well as castings and alloy-based products. Foxconn has partnered with Vedanta to make semiconductors in India, as the electronics giant looks to diversify its business amid a global chip shortage.

Electric vehicles (EVs) and wind and solar farms, which can contribute to carbon emission reduction, need copper favoured in applications. Total copper demand from the EV sector is expected to rise to nearly to 3.3 mt by 2030 from under 500,000 tonnes this year.

The renewable energy sector could see copper demand rise from around 650,000 tonnes in 2020 to over 1.3 mt in 2030. Global copper demand is expected to rise to more than 26 mt in 2025 from around 23 mt this year, much of this growth coming from renewable energy and EVs.

On an average, a battery electric vehicle (BEV) contains about 83 kg of copper and a plug-in hybrid electric vehicle (PHEV) contains about 60 kg compared to an internal combustion engine car, which needs an average of 23 kg of copper.