Operational review

Zinc India

THE YEAR IN BRIEF

Mine production progressively improved during the year with record ore production for the full year up 6% y-o-y to deliver a record 16.3 mt, supported by strong production growth at Zawar mines, SK Mines and Rampura Agucha mine, which were up 12%, 8% and 6% respectively. Highest every mined metal production was up 5% y-o-y to 1,017 kt primarily on account of higher ore production and milling recovery, partly offset by lower ore metal grade.

Occupational health & safety

It is with deep sadness that we report the loss of four colleagues (Business partners) in work-related incidents at our managed operations. These incidents happened despite continuous efforts to eliminate fatalities and attain a Zero Harm work environment. A thorough investigation was conducted to identify the causes of these incidents and to share lessons learned across HZL, with the aim of preventing repeat or similar incidents.

LTIFR for the year was 0.79 as compared to 0.97 in FY2021. LTIFR for the last quarter was 0.62 as compared to 0.89 in FY2021 driven by several safety awareness, investigation and prevention initiatives. As compared to a year ago, number of LTIs decreased from 13 to 10 in the fourth quarter. LTIFR for the year was 0.79 (total 50 LTIs for the year). There has been greater management focus to bring a cultural change via felt leadership programs, town halls, enabling tools like safety whistle blower as well as reward & recognition for near-miss reporting.

During the second wave of COVID-19, we set up an oxygen bottling plant in record 5 days; it was commissioned to produce 500 oxygen cylinders per day, helping local government and hospitals in the fight against COVID-19. New field hospital was established in Dariba, with a capacity of 100 beds with air conditioning facility and medical assistance. Apart from these efforts, the Company has extended all kinds of support to the local health administration for fighting against COVID-19. Unfortunately, we reported loss of 59 employees and contract employees during wave 1 and wave 2 of COVID.

To ensure vaccination to all the employees, business partners and their family members, mega drives were organised during the year. The company has also introduced the Group Corona Kavach Policy that covers more than ~25000 business partners in Rajasthan and Pantnagar in Uttarakhand. This cashless policy covers all corona related diagnostic charges including prehospitalisation and post-hospitalisation expenses. There is also a dedicated 24×7 Covid Care Apollo helpline number to provide any kind of healthcare support and assistance for all employees and their dependents. Post covid care drive also initiated to boost the motivation level of the employee. Company has also rolled out Group Term Life policy which provides life (term) insurance protection in case of death of active regular executive. The coverage limit is 5 Times of Fixed Salary of each employee up to a max. Limit i.e., INR 5.5 Cr.

During the year we commissioned first made in India emergency escape route staircase type in underground at Rajpura Dariba Mine and underground rescue station at Rampura Agucha Mine which significantly improves the response time in emergency cases. Qualitative and Quantitative Exposure Assessment completed for all units and exposure mitigation plan developed. 22 Digitised safety modules launched for easy understanding of safety standard requirements and road map developed to eliminate manual charging by all mining locations.

HZL is also using & deploying IOT solutions for safety of its employees and equipment. Connected work force solution which are safety wearables & tags, is one such technology that will alert management proactively to ensure safety of employees and to intervene on priority for necessary support and rescue. Detect technology is another IOT that uses of Artificial intelligence and video analytics, of presently installed CCTV cameras and identify and capture Unsafe conditions and Unsafe acts which gets reported and help Line leadership to act on violators and build around the clock assurance for preventing safety incidents. Through this technology, we are achieving autonomous system for detection of safety violations during turnarounds through a network of cameras, supported by back-end data analytics & frontend real-time reporting.

Demonstrating the highest standards of health and safety management during the year, Chanderia CPP and Debari both received the prestigious ‘Sword of Honor’ from British Safety Council for showing excellence in the management of health and safety risks at work. This came as a double swoop following the top Five-Star rating achieved by Chanderia CPP and Debari, for successfully completing the best practice Occupational Health and Safety Audit conducted by the British Safety Council. Our Kayad Mine was also awarded the National Safety Award from the Government of India for Longest Accident-Free in metal mines and for lowest injury frequency rate (LIFR).

~25,000

BUSINESS PARTNERS COVERED BY THE GROUP CORONA KAVACH POLICY

Environment

Hindustan Zinc commits to ‘Long-term target to reach netzero emissions by 2050’ in alignment with Science Based Targets initiative (SBTi) aiming to have clearly defined path to reduce emissions in line with the Paris Agreement goals. To achieve the target, we are working towards improving our energy efficiency, switching to low carbon energy sourcing, introducing battery operated electrical vehicles and increasing the role of renewables in our energy mixes.

Company has made notable technological advancements in energy conservation. Zinc Smelter Debari has revamped the Cell House and eliminated current losses through electrolytic cells by successfully replacing 600+ concrete cells with poly concrete cells. As a result, the power rating has improved. Additionally, the turbine revamping project is certified as a carbon reduction project by VERRA (the world’s most widely used voluntary GHG program) resulting in a decrease of 270,000 tCO2e per year. For Decarbonising the future of Indian mining, Hindustan Zinc partnered with leading global manufacturers for introducing BEVs in underground mines. All units of HZL are certified to ISO 50001 (Energy Management system).

At HZL, we recognise the reality of climate change, Therefore, our risk management processes embed climate change in the understanding, identification, and mitigation of risk. We have published our first TCFD (Task Force on Climate-related financial disclosure) report during the year which sets the adoption of the TCFD framework for climate change risk and opportunity disclosure. HZL actively participated in ‘Business Leaders Group COP26’ and was engaged for shaping the agenda for COP26 which was held at Glasgow (UK) in Nov’21. Endeavoring towards sustainable organisation HZL enhanced the governance by establishing Board Level ESG & Sustainability Committee formed to overview the ESG progress of the organisation.

Hindustan Zinc joins the Taskforce on Nature-Related Financial Disclosures (TNFD) Forum to tackle naturerelated risks. Miyawaki Method of Afforestation pilot project completed at DZS and horizontal deployment will be done across HZL. 3 years Engagement with IUCN will help in development of Biodiversity Management Plan focusing No Net Loss approach to achieve Sustainability Goal 2025.

One of the most notable achievements has been the successful commissioning of a 3000 KLD Zero Liquid discharge (RO-ZLD) plant at the Zinc Smelter Debari. Expansion of 3200 KLD ZLD plant at Dariba Smelter is under progress and shall be commissioned by first Quarter of FY 23. Apart from that Zawar (ZM) and Rampura Agucha Mine ZLD projects of 4000 KLD capacity each have been initiated to improve recycling and strengthen the zero discharge. Like ZM, Dry tailing plant at Rajpura Dariba Mine is also under final stage of commissioning and will result in significant amount of water recovery from the tailings.

The company has also commissioned 10 MLD Sewage Treatment Plant (STP) and 5 MLD facility in Udaipur, bringing the total Udaipur STP capacity built up by it to 60 MLD. This will treat nearly all of Udaipur’s sewage, and the treated sewage is used by Beneficiation, Smelters and Captive Power Plants, lowering its freshwater use. In the area of water stewardship Rampura Agucha Mine has also completed astonishing project of executing groundwater recharge intervention project across 4 blocks of Bhilwara district having ground water recharge potential of 8.5 MCM/ annum.

Successful public hearing was conducted during the year for Expansion of Zawar Mines from 4.8 million TPA (Tones per annum) to 6.5 Million TPA and Beneficiation from 4.8 Million TPA to 7.3 Million TPA.

One of the most notable achievements has been the successful commissioning of a 3000 KLD Zero Liquid discharge (RO-ZLD) plant at the Zinc Smelter Debari.

Our sustainability activities received several endorsements during the year

- The Company is ranked 1st in Asia-Pacific and globally 5th in Dow Jones Sustainability Index in 2021 amongst Mining & Metal companies. (1st in environment Dimension among the metal and mining sector globally)

- Company won the 1st Bronze Medal and been featured in the prestigious Sustainability Yearbook for the fifth year in a row by S&P Global

- The company received the award for ‘Outstanding Accomplishment in Corporate Excellence and Dariba smelter received the award for excellence in Environment management’ in 16th CII-ITC Sustainability Awards

- HZL received IEI Industry Excellence Award 2021, instituted by The Institution of Engineers (India)

- HZL’s RAM and Kayad mine received 5 Star Rated Mines’ award by the Ministry of Mines, Govt. of India

- Hindustan Zinc wins at ESG India Leadership Awards – Leadership in Environment and Green House Gas Emissions Reduction Categories organised by ESGRisk.ai, India’s first ESG rating company

- Kayad received FIMI Bala Gulshan Tandon Award of Excellence for the year

- HZL has been awarded the Most Sustainable Company in the Mining Industry by World finance at their Sustainability Awards 2021

- Hindustan Zinc has been Awarded as Most Innovative Project (CLZS- Restoration of Jarofix Yard Project) and Innovative Project (RDMBiodiversity Park) in the renowned CII National Award for Environmental Best Practices 2021

- Hindustan Zinc’s Dariba Smelting Complex wins Prestigious CII-National Awards for Excellence in Water Management

Hindustan Zinc is a law-abiding corporate citizen and will always uphold the law. National Green Tribunal (NGT) appointed a seven-member committee of subject matter experts, and this committee submitted its report recommending plantation of trees worth INR 90 lakh, which Hindustan Zinc Limited is willing to comply with.

However, NGT has directed that the company under the precautionary principle should spend INR 25 crores towards community welfare programmes under the aegis of a newly constituted committee. For us, our local communities have always been an integral part of all our social initiatives and will continue to be so.

While we continue with our social welfare work on ground, Hindustan Zinc Limited will be filing an appeal against certain observations made by NGT, that are contradictory to the finding of the expert committee and the realities on the ground.

We are already preparing a blueprint for INR 1000 crore CSR plan, to be executed in the next 4 to 5 years, along with the local administration and stakeholders for the socio-economic welfare of communities in all our areas of operations.

Production performance

PRODUCTION (kt)

| FY2022 | FY2021 | FY2020 | |

|---|---|---|---|

| Total mined metal | 1017 | 972 | 5% |

| Refinery metal production | 967 | 930 | 4% |

| Refined zinc –integrated | 776 | 715 | 8% |

| Refined lead – integrated1 | 191 | 214 | (11%) |

| Production – silver (in tonnes)2 | 647 | 705 | (8%) |

1. Excluding captive consumption of 6,951 tonnes in FY2022 vs. 6,424 tonnes in FY2021.

2. Excluding captive consumption of 37.4 tonnes in FY2022 vs. 34.6 tonnes in FY2021.

Operations

For the full-year, ore production was up 6% y-o-y to 16.3 million tonnes on account of strong production growth at Zawar mines, SK mines & Rampura Agucha mines, which were up 12%, 8% and 6% respectively. FY2022 saw the best ever Mined metal production of 1,017,058 tonnes compared to 971,975 tonnes in the prior year in line with higher ore production across Mines supported by improved recovery

For the full year, we saw our ever-highest metal production, up 4% to 967 kt in line with better plant and MIC availability, while silver production was 8% lower at 647 MT in line with lower Lead metal production.

Production performance

PRICES

| Particulars | FY2022 | FY2021 | % Change |

|---|---|---|---|

| Average zinc LME cash settlement prices US$ per tonne | 3,257 | 2,422 | 34% |

| Average lead LME cash settlement prices US$ per tonne | 2,285 | 1,868 | 22% |

| Average silver prices US$/ounce | 24.58 | 22.89 | 7% |

Global zinc consumption growth will slow from the 7.1% seen in 2021 to 2.3% in 2022 and an average of 1.7% p.a. in 2023 and 2024. Compared with zinc’s recent pre-pandemic history, this is still a robust growth rate and sufficient to lift consumption to 14.5Mt, surpassing the 2017 all-time high of 14.2Mt. In 2023 and 2024, the pace of growth is projected to moderate further with average growth of 1.7% pa or approximately 250kt/a, lifting consumption to just under 15Mt. Tightness in the refined market continues to be evidenced in the spot markets of Europe and North America where spot premiums remain high. However, the backwardation together with high prices and premiums is encouraging consumers to buy on a hand to mouth basis. Meanwhile, the concentrate market has seen indicative spot TCs jump to $135-150/t of concentrate, up from $85/t in December 2021. Spot TCs will have to remain at elevated levels until the arbitrage of Chinese prices over the LME returns, or any shortage of domestic concentrates force Chinese smelters into the international market.

Although the Russia/Ukraine conflict has rocked many commodities markets, the impact on the zinc market has been negligible, a reflection of the fact that Ukraine is of modest importance as a zinc consumer. The roughly 20kt/a of zinc consumed by the country is largely supplied by Kazzinc. With Ukraine’s 500kt of continuous galvanising capacity being idled in the face of the conflict, the zinc normally destined for the country will be readily re-directed into the tight refined markets in other parts of the world. The more profound impacts for zinc will be indirect. Energy prices were already high, and the conflict has only exacerbated the situation. As a result, a significant easing of European electricity prices, and the financial pressure on Europe’s smelters is unlikely this summer.

ZINC DEMAND – SUPPLY

| Zinc Global Balance In KT | CY2020 | CY2021 | CY2022 E |

|---|---|---|---|

| Mine Production | 12276 | 13094 | 13083 |

| Smelter Production | 13679 | 13867 | 13937 |

| Consumption | 13205 | 14147 | 14469 |

The metal market is little changed, the refined zinc market outside of China is fundamentally tight.The cash-to three months spread has been in backwardation for virtually all of the first two months of the year. Although the average backwardation has halved from $30/t in January to just under $15/t in February, it remains significant. Meanwhile, LME stocks have continued to drip lower ending February at 144kt, 10kt lower than January. At the equivalent of just 4 stock days this is extremely low.

India’s manufacturing PMI increased to 54.9 in February, a slight improvement from January’s 54.0, signalling a stronger improvement of the sector. “The seasonally adjusted IHS Markit India Manufacturing Purchasing Managers’ Index® (PMI®) was at 54.9 in February, up from 54.0 in January and signalling a stronger improvement in the health of the sector. Growth has now been seen in each of the latest eight months, with the headline figure remaining above its long-run average of 53.6,” stated IHS Markit in its report.

The report added that firms responded to strong increases in new work intakes by lifting production, input buying and stocks of purchases. Employment fell at the softest pace and favourable demand conditions improved sentiments to its strongest since October. Demand for raw materials strengthened to lead to another marked rate of input price inflation.

As government spending continues in infrastructure, highways, electrification and transmission projects, the major demand for zinc came from the structural segment. Buying activity was higher in February for Indian manufacturers due to higher output in new order inflows.

UNIT COSTS

| Particulars | FY2022 | FY2021 | % Change |

|---|---|---|---|

| Unit costs (US$ per tonne) | |||

| Zinc (including royalty) | 1,567 | 1,286 | 22% |

| Zinc (excluding royalty) | 1,122 | 954 | 18% |

For the full year, zinc COP excluding royalty was $1122, higher by 18% y-o-y (18% higher in INR terms). The COP has been affected by higher coal & commodity price increase partially offset by benefits from better volumes, operational efficiencies & recoveries.

FINANCIAL PERFORMANCE

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Revenue | 28,624 | 21,932 | 31% |

| EBITDA | 16,161 | 11,620 | 39% |

| EBITDA margin (%) | 56% | 53% |

Revenue from operations for the year was ₹28,624 crore, up 31% y-o-y, primarily on account of higher metal prices, higher production & higher sulphuric acid realisations

EBITDA in FY2022 increased to ₹16,161 crore, up 39% y-o-y. The increase was primarily driven by higher revenue and partly offset by higher cost of production.

Projects

In HZL journey of 1.25 mtpa MIC expansion, some of key projects are under execution at RD Mines complex. We have successfully completed RD Mines Shaft & Conveyor upgradation for enhancement of ore hoisting capacity in Q3 of this FY. In line with our ESG journey, we have completed installation of Dry Filtration & Paste fill plant to enable effective tailings managements by switching from Wet to Dry tailing management system. Commissioning of plant will start by Q1 of next FY. For enhancing metal recovery, we have placed order for RD Beneficiation plant revamping, enabling better Pb, Zn & Ag recoveries and improving plant reliability by replacing obsolete Grinding, Floatation & Filtration circuits. Civil construction already ongoing and plant is scheduled to be commissioned in Q3 of next FY.

At Zawar, in order to enhance the ventilation capacities and working conditions of West Mochia and North Baroi mines, installation of underground ventilation fans has started. For increasing the capacity of Tailing storage Facility, design and stabilisation studies have been conducted and the dry stacking is under progress.

The development of North Decline (ND1) was completed at Rampura Agucha (RA) mine. This improves the accessibility of shaft section, alternate emergency evacuation, ease in mine equipment deployment at lower levels of mine, face charging with emulsion explosives, face drilling with long feed jumbo, etc.

Treatment of Raw Zinc Oxide (RZO) in RKD circuit (component of overall Fumer project) continued during the entire year. Process for applying employment visa for the Chinese experts coming for Fumer commissioning has started. Regular follow ups are being done with government authorities for speedy issuance of the visas. Fumer Commissioning is targeted by Q1 of FY23.

Exploration

Zinc India’s exploration objective is to upgrade the resources to reserves and replenish every ton of mined metal to sustain more than 20 years of metal production by fostering innovation and using new technologies. The Company has an aggressive exploration program focusing on delineating and upgrading Reserves and Resources (R&R) within its license areas. Technology adoption and innovations play key role in enhancing exploration success.

The deposits are ‘open’ in depth, and exploration has identified number of new targets on mining leases having potential to increase R&R over the next 12 months. Across all the sites, the Company increased its surface drilling to assist in Resource addition and upgrading Resources to Reserves.

In line with previous years, the Mineral Resource is reported on an exclusive basis to the Ore Reserve and all statements have been independently audited by SRK (UK).

Strategic Priorities & Outlook

Our primary focus remains on enhancing overall output, cost efficiency of our operations and disciplined capital expenditure. Whilst the current economic environment remains uncertain our goals over the medium term are unchanged.

Our key strategic priorities include:

- Further ramp up of underground mines towards their design capacity, deliver increased silver output in line with communicated strategy

- Sustain cost of production to be in the range of $1125- $1175 per tonnes through efficient ore hauling, higher volume & grades and higher productivity through ongoing efforts in automation and digitisation

- Disciplined capital investments in minor metal recovery to enhance profitability

- Increase R&R through higher exploration activity and new mining tenements, as well as upgrade resource to reserve

On an exclusive basis, total ore reserves at the end of FY2022 totalled 161.21 million tonnes and exclusive mineral resources totalled 286.73 million tonnes. Total contained metal in Ore Reserves is 9.57 million tonnes of zinc, 2.45 million tonnes of lead and 298.3 million ounces of silver and the Mineral Resource contains 13.17 million tonnes of zinc, 5.86 million tonnes of lead and 576.27 million ounces of silver. At current mining rates, the R&R underpins metal production for more than 20 years.

Zinc International

THE YEAR IN BRIEF

During FY2022, Zinc International continued to ramp up production from its flagship project Gamsberg mine and achieved record production of 170kt. Several milestone projects were completed including rougher cells commissioning at Gamsberg resulting in throughput increase from 535tph to 575tph and the BMM plant debottlenecking project which resulted in throughput of 238tph, up from 213tph.

Black Mountain continued to have a stable production of 52kt, slightly lower than FY2021 due to lower head grades and mining challenges including Deeps Shaft dewatering system failure.

Skorpion Zinc has been under Care and Maintenance since start of May 2020, following cessation of mining activities due to geotechnical instabilities in the open pit. Activities to restart the mine are progressing well.

Safety

The LTIFR rate improved to 1.1 in FY2022 (FY2021 1.7). Black Mountain Mine had a fatality on 11 November 2021 when a business partner employee succumbed to injuries sustained after a rockslide inside the blast hole. As part of the remedial measures, the drilling and blasting of blastholes were reviewed to improve fragmentation and eliminate boulders. Planned Task Observations are conducted to enforce these remedial measures and prevent employees entering blast holes.

With regards to Gamsberg South Pit failure that happened in November 2020, rescue and recovery search are continuing and remains our first priority. Revised plan and approach has been shared with Department of Mineral Resources with expected date of completion being Q1 FY2023.

Employee engagement is an integral part of our Safety strategy, and our leaders are required to conduct Frequent, Caring and Risk based Visible Felt Leadership Interactions to coach and address behavioural issues at both our operations. Both Black Mountain and Gamsberg Mines have embarked on a Critical Control Management programme where all the employees are required to know the Top High-Risk activities in their area of work as well as the mitigating strategy.

Occupational Health

At Vedanta Zinc International, we take the health and safety of our employees and stakeholders very seriously and we remain committed to communicating timeously and transparently to all stakeholders. Since the start of the COVID-19 pandemic, we have recorded 880 positive cases, 873 recoveries and 6 deceased. We have implemented stringent protocols to mitigate COVID-19 spread and we have social programs in place to assist communities in which we operate. We have also embarked on a Workplace (and community) Vaccination programme to ensure 100% coverage of vaccination for the employees and their families.

Airborne particulate management remains a key focus in reducing Lead and silica dust exposures of employees. Black Mountain Mine has had 9 blood lead withdrawals for FY2022, against more stringent limits than required by law. We have strengthened our Employee Wellness Programme, focussing on the increased participation of employees and communities in VCT for Aids / HIV, Blood donation and wellness.

Environmental

Gamsberg further reduced water consumption in the plant by implementing conversions from potable (RAW) water to process water and successfully reduced the plant water intensity to 0.45m3/t. A strategy that will enable Vedanta Zinc International to transition to a low carbon operation was finalised and the two main projects is in early stages of implementation. These projects include reducing reliance on the coal-based electricity from ESKOM through implementation of Renewable energy replacements of 77MW for Black Mountain and Gamsberg. The first phase of implementing a programme to replace current diesel fuelled underground TMM with Battery Electrical Vehicles commenced which will culminate in a full replacement strategy of the total BMM mining TMM fleet with Battery Electrical Vehicles.

The Gamsberg Nature Reserve Strategic Management Plan has approved, and the properties transferred to Department Public Works. A major campaign saw the collaboration between the South African police force, Department Environment Nature conservation and SANBI, to spread awareness of biodiversity and endangered species of the Region.

PRODUCTION PERFORMANCE

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Total production (kt) | 223 | 203 | 10% |

| Production – mined metal (kt) | |||

| BMM | 52% | 58% | (9%) |

| Gamsberg | 170% | 145% | 18% |

| Refined metal Skorpion* | - | - | - |

* The mine is under care & maintenance since May’20 onwards

Operations

During FY2022, total production stood at 223,000 tonnes, 10% higher y-o-y. This was primarily through ramp up and higher production in Gamsberg.

At BMM, production was 52,000 tonnes, 9% lower y-o-y. This was mainly due to lower grades of zinc (2.1% vs 2.6%), lead (2.1% vs 2.3%), lower zinc recoveries (75.2% vs 80.2%) and lower lead recoveries (81.6% vs 81.8%) offset by 13.6% higher throughput.

Gamsberg’s production was at 170,000 tonnes as the operation continues to ramp up with improved performance during current financial year.

At Skorpion Zinc engagement with technical experts to explore opportunities of safely extracting the remaining ore is ongoing. The pit optimisation work is complete. The business is currently evaluating options to restart mining.

UNIT COSTS

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Zinc (US$ per tonne) unit cost | 1,442 | 1,307 | 10% |

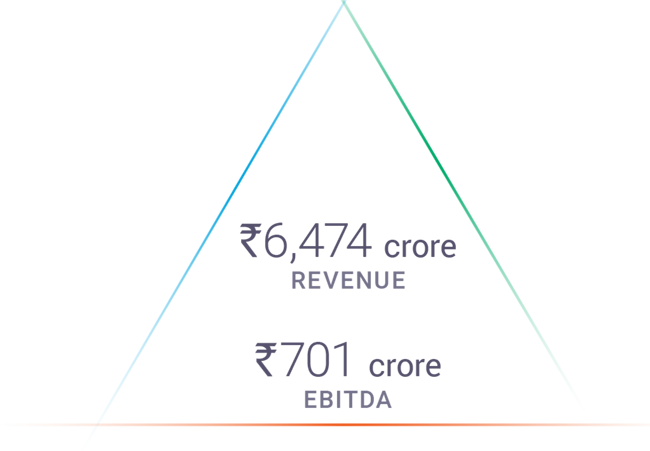

FINANCIAL PERFORMANCE (₹ crore, unless stated)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Revenue | 4,484 | 2,729 | 64% |

| EBITDA | 1,533 | 811 | 89% |

| EBITDA margin | 34% | 30% |

The unit cost of production increased by 10% to US$1,442 per tonne, from US$1,307 per tonne in the previous year. This was mainly driven by higher mining cost and local currency appreciation offset by higher production at Gamsberg and higher BMM copper production and credits.

During the year, revenue increased by 64% to ₹4,484 crore, driven by higher sales volumes compared to FY2021 due to higher production at Gamsberg and higher LME prices, partially offset by higher costs. EBITDA increased by 89% to ₹1,533 crore, from ₹811 crore in FY2021 mainly on account of higher LME prices and sales volumes.

Projects

Refinery Conversion

Substantial progress has been made on Skorpion Zinc Refinery conversion Project with the completion of FEED, feasibility study, tendering activities & techno-commercial adjudication. All regulatory approval is in place to start project execution. Previously completed feasibility study also has been updated. With power tariffs being very critical for the viability of the project, discussions/ negotiations are happening with the state power utility along with the option of renewable power which is also being explored. We are only waiting for confirmation of power tariff to take the final decision and starting the execution on the ground by H1 2022-23.

Gamsberg Phase 2

Gamsberg Phase 2 project includes the mining expansion from 4 mtpa to 8 mtpa and Construction of New Concentrator plant of 4 mtpa, taking the total capacity to 8 mtpa. This will have additional Metal in concentrate (MIC) of 200+ which will take the total MIC production capacity to 450+. The EOI for the Concentrator plant was floated and proposals were received. The project was approved by Vedanta Board in March 2022. The execution philosophy is on EPC basis and the project is on track for start of execution in Q1 FY 2023.

Gamsberg Smelter

We would set-up a 300 ktpa Smelter Project by repeating the conventional Roaster-Leach-Electrolysis(R-L-E) process along with necessary modifications required for capacity upgrade to treat Gamsberg Concentrate. We have received the environmental approval for Bulk water pipeline construction and outcome of ESIA is also expected in April 2022. We are appointing an Advocacy partner for engaging with Gov. of South Africa on the other critical success factors like SEZ, power price, sulphuric acid offtake, logistics infrastructure and other regulatory approvals which are absolutely vital for economic feasibility of the project.

Black Mountain Iron Ore project

This is a project to recover iron ore (magnetite) from the BMM tailings. The 0.7mtpa Iron Ore plant is currently under execution with the EPC contractor being Lead EPC. Owners’ Engineer for the project has been appointed. World class Iron Ore will be produced from the new plant with Fe grade > 68%. First production is expected in August 2022.

Exploration

5.8% reduction in reserve metal tons from 8.3Mt to 7.8Mt, with 24.0% increase in resources from 21.9Mt to 27.2Mt metal

Total R&R for VZI increased from 566Mt to 671Mt of ore, while metal increased from 30.2Mt to 35.0Mt (15.9% increase in total metal)

Reduction in reserve largely attributed to smaller open pit design at Gamsberg North, while main factors affecting resources is discovery of Gamsberg Kloof deposit, remodelling of Gamsberg East and lower CoGs for resources.

Strategic Priorities & Outlook

Zinc International continues to remain focused to improve its YoY Production by sweating its current assets beyond its design capacity, debottlenecking the existing capacity and adding capacity through Growth Projects. Our Immediate priority is to ramp up the performance of our Gamsberg Plant at Designed capacity and simultaneously develop debottlenecking plan to increase Plant capacity by 10% to 4.4Mt Ore throughput. Likewise, BMM continues to deliver stable Production performance and focus is to debottleneck its Ore volumes from 1.6Mt to 1.8Mt. Skorpion is expected to remain in Care and Maintenance for H1 FY23 while management is assessing feasible & safe mining methods to extract Ore from Pit 112. Zinc International continues to drive cost reduction programme to place Gamsberg operations on 1st Quartile of global cost curve with COP< US$1100 per tonne.

In addition to above, Core Growth strategic priorities include:

- Completion of Magnetite project in H1 FY 2023.

- Commencement of construction activities of Gamsberg Phase 2 project with aim to start production in H2 FY2024

- Continue to improvise Business case of Skorpion Refinery Conversion Project and Gamsberg Smelter Project through Government support, Capex and Opex reduction

Oil & Gas

THE YEAR IN SUMMARY

During FY2022, Oil & Gas business delivered gross operated production of 161 kboepd, down by 1% y-o-y, primarily driven by natural reservoir decline at the MBA fields. The decline was partially offset by addition of volumes from ramp up of gas volumes, commissioning of Aishwariya Barmer Hill facility, impact of polymer injection in Bhagyam and Aishwariya fields, new infill wells brought online in Mangala field and reduced operational downtime.

In OALP blocks, seismic acquisition program has been completed in Assam, Cambay, Rajasthan and Offshore region. As part of the 15 well drilling program, 11 wells have been drilled till date across basins. Of these, two hydrocarbon discoveries in Rajasthan (KW-2 Updip and Durga -1) and one in Cambay (Jaya-1) have been notified as oil and gas discovery.

Occupational Health & Safety

There are seven lost time injuries (LTIs) in FY2022. Frequency rate stood at 0.20 per million-man hours (FY2021: 0.16 per million-man hours) amidst increased development activities.

Our focus remains on strengthening our safety philosophy and management systems. We were recognised with awards conferred by external bodies:

- Five Star Rating in Occupational Health & Safety Audit conducted by British Safety Council for Mangala, Bhagyam and Aishwarya Mines

- Raageshwari Gas Terminal (RGT) recognised for Quality with Excellence Award in the 46th International Convention on Quality Control 2021

- Golden Peacock Occupational Health & Safety Award 2021 for Cambay asset

- Gold award for Ravva asset from Quality Circle Forum of India (QCFI) at 21st Chapter Convention

- Apex Gold Award in Occupational Health & Safety for Mangala, Bhagyam and Aishwarya mines

- Cairn awarded Greentech Safety Excellence Award 2021.

Cairn Oil & Gas has taken various initiatives:

- COVID-19 mass vaccination drive for employees, their family members, and Business Partners. 100% of eligible employees of Cairn and Business Partners have completed both dose of vaccination

- “5S” certification for Mangala, Bhagyam and Aishwarya Mines

- Launched Business Partner’s awards to recognise HSE initiatives to make workplace and work environment safe

Digital initiatives: Drone based inspection of Overhead Power Lines, Artificial Intelligence (AI) based CCTV Camera in Suvali, High voltage proximity detectors for cranes and tippers to avoid incident with overhead electrical lines, e-Lock for crude tankers, Solar based traffic light system, Contactless Breath Analyzer, Hazard reporting through Kiosk and Mobile App etc.

Environment

Our Oil & Gas business is committed to protect the environment, minimise resource consumption and drive towards our goal of ‘zero discharge’. Highlights for FY2022 are as:

- NABL accreditation (ISO 17025:2017) and ILACMRA (International Laboratory Accreditation Cooperation - Mutual Recognition Arrangement) approval for Environment Lab at Mangala Processing Terminal, Barmer

- Leaders Award in Sustainability 4.0 under Mega large business category conferred by Frost & Sullivan and TERI

- Reduction in GHG emission:

a. Commissioning of pipeline from Raag Oil to RGT for gas transportation instead of flaring resulted in ~0.8 mmscfd gas with annual GHG reduction potential of 32,500 tons of CO2e

b. Diversion of condensate from Bridge plant to RDG resulted into saving of 1 mmscfd gas with annual GHG reduction potential of 27,750 tons of CO2e/annum

c. Commissioned 100 KWP Solar Plant at Sara WP#01

d. Green OB project: Commissioned 530 KWP Solar Plant at Operation Base Camp at MPT (Annual GHG reduction potential of 790 tons of CO2e/annum

- Reject water treatment plant commissioned at MPT to increase produced water recycling rate: ~194,811 KL recovered

- Hydrocarbon recovery by processing of skimmed oil: ~18,233 bbls

PRODUCTION PERFORMANCE

| Unit | FY2022 | FY2021 | % Change | |

|---|---|---|---|---|

| Gross operated production | Boepd | 160,851 | 162,104 | (1%) |

| Rajasthan | Boepd | 137,723 | 132,599 | 4% |

| Ravva | Boepd | 14,166 | 19,177 | (26%) |

| Cambay | Boepd | 8,923 | 10,329 | (14%) |

| OALP | Boepd | 39 | - | 100% |

| Oil | Boepd | 135,662 | 140,353 | (3%) |

| Gas | Mmscfd | 151 | 131 | 15% |

| Net production – working interest | Boepd | 103,737 | 101,706 | 2% |

| Oil* | Boepd | 87,567 | 88,923 | (2%) |

| Gas | Mmscfd | 97 | 99 | 26% |

| Gross operated production | Mmboe | 58.7 | 59.2 | (1%) |

| Net production – working interest | Mmboe | 37.9 | 37.1 | 2% |

* Includes net production of 535 boepd in FY2022 and 441 boepd in FY2021 from KG-ONN block, which is operated by ONGC. Cairn holds a 49% stake

Average gross operated production across our assets was 1% lower y-o-y at 160,851 boepd. The company’s production from the Rajasthan block was 137,723 boepd, 4% higher y-o-y. The increase was primarily due gains realised from ramp up of gas sales, continued impact of polymer injection in Bhagyam & Aishwariya fields and new infill wells brought online in Mangala field. Production from the offshore assets, was at 23,089 boepd, 22% lower y-o-y, owing to natural field decline.

137,723boepd

AVERAGE GROSS PRODUCTION FROM THE RAJASTHAN BLOCK

Rajasthan block

Gross production from the Rajasthan block averaged 137,723 boepd, 4% higher y-o-y. The natural reservoir decline has been offset by ramp-up of gas production, infill wells in Mangala field and impact of polymer injection in Bhagyam and Aishwariya fields.

Gas production from Raageshwari Deep Gas (RDG) averaged 158 million standard cubic feet per day (mmscfd) in FY2022, with gas sales, post captive consumption, at 128 mmscfd.

On 26th October 2018, the Government of India, acting through the Directorate General of Hydrocarbons (DGH), Ministry of Petroleum and Natural Gas, granted its approval for a ten-year extension of the PSC for the Rajasthan block, RJ-ON-90/1, subject to certain conditions, with effect from 15th May 2020. The Division Bench of the Delhi High Court in March 2021 set aside the single judge order of May 2018 which allowed extension of PSC on same terms and conditions. We have filed a Special Leave Petition (SLP) in Supreme Court against this Delhi High court judgement. We have also filed application for amendment of SLP to bring additional grounds and question of law on 8th March 2022 along with the application for seeking interim relief.

We have served notice of Arbitration on the GoI in respect of the audit demand raised by DGH based on PSC provisions. The Government has accepted it and the arbitration tribunal stands constituted. It is our position that there is no liability arising under the PSC owing to these purported audited exceptions. The audit exceptions do not constitute demand and hence shall be resolved as per the PSC provisions.

The Tribunal had a first procedural hearing on 24th October on which Vedanta also filed its application for interim relief. The interim relief application was heard by the Tribunal on 15th December 2020 wherein it was directed that the GoI should not take any coercive action to recover the disputed amount of audit exceptions which is presently in arbitration and that during the arbitration period, the GoI should continue to extend the tenure of the PSC on terms of current extension. The GoI has challenged the said order before the Delhi High court which is now listed on 25th May 2022.

We have filed Statement of Reply and Defence to Counterclaim on 30th November 2021. Rejoinder to Statement of Reply and Statement of Reply to Defence to Counterclaim has been filed by GoI on 7th March 2022.

The GoI has also filed application before the Tribunal objecting to its jurisdiction to decide issues arising out of or relating to the PSC extension policy dated 7th April 2017, the Office Memorandum dated 1st February 2013, as amended and audit exceptions notified for FY 2016-18. We have filed our objection to this assertion by GoI. Tribunal’s Procedural Order dated 23rd September 2021 dismissed the motion and ordered costs in favour of Vedanta. The costs are not payable until the end of the arbitration or further order in the meantime.

Further, on 23rd September 2020 GoI filed an application for interim relief before Delhi High Court seeking payment of all disputed dues. The bench has not been inclined to pass any ex-parte orders and the matter is now listed for hearing on 25th May 2022.

Further to above stated letter from GoI on 26 October 2018, in view of pending non-finalisation of the Addendum to PSC, the GoI granted, permission to the Oil & Gas business to continue petroleum operations in Rajasthan block, till the execution of the Addendum to PSC or 14th May 2022, whichever is earlier.

Ravva block

The Ravva block produced at an average rate of 14,166 boepd, lower by 26% y-o-y, owing to natural field decline. Previous year production included impact of infill drilling campaign.

Cambay block

The Cambay block produced at an average rate of 8,923 boepd, lower by 14% y-o-y. This was primarily due to natural field decline partially offset by well interventions and production optimisation measures.

PRICES

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Average Brent prices –US$/barre | 81.15 | 44.3 | 83% |

Crude oil price averaged US$81.15 per barrel, compared to US$44.3 per barrel in FY2021. The continuous upward movement is mostly driven by accelerating global oil market rebalancing, increasing vaccination rates, continued easing of COVID-19-related mobility restrictions and increasing geopolitical tensions around the world.

Early in the year, demand dampened amid deteriorating situation around the world due to surge in COVID-19 Delta variant taking the oil prices downwards. However, increased COVID-19 vaccination rate, continued efforts by OPEC to follow their scheduled crude oil production increase of 400,000 barrels per day (b/d) and natural factors effecting production in US, offset the sudden downward spikes in the prices due to planned and unplanned outages.

Later during the year, crude prices remained volatile bolstered by fast spreading omicron variant, raising demand concerns and need for harsh lockdowns. However, low death rates and higher vaccinations around the world nullified the concerns over demand.

Russian invasion further into Ukraine on February 24 and the subsequent escalation of armed conflict, contributed to rising crude oil prices crossing 100$/bbl mark. The increase in crude oil prices reflects potential effects of the extensive sanctions levied by the United States, European Union, and others on Russian entities in response to Russia’s continued invasion of Ukraine, as well as the risk of potential disruptions to crude oil and energy production and infrastructure related to the conflict. In addition to western sanctions and the U.S. import ban, weather-related disruptions at Kazakhstan’s Caspian Pipeline Consortium (CPC) terminal along Russia’s Black Sea Coast, as well as a fire related to a Houthi missile attack at a Saudi Aramco oil storage and distribution facility in Jeddah, contributed to additional volatility and risk of supply disruptions, led to a continued rally in prices.

FINANCIAL PERFORMANCE (₹ crore, unless stated)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Revenue | 12,430 | 7,531 | 65% |

| EBITDA | 5,992 | 3,206 | 87% |

| EBITDA margin | 48% | 43% |

Revenue for FY2022 was 65% higher y-o-y at ₹12,430 crore (after profit petroleum and royalty sharing with the Government of India), as a result of the increase in oil prices. EBITDA for FY2022 was at ₹5,992 crore, higher by 87% y-o-y in line with the higher revenues.

The Rajasthan operating cost was US$10.1 per barrel in FY2022 compared to US$7.7 per barrel in the FY2021, primarily driven by increase in polymer commodity index, owing to oil price rally and increased interventions. Previous year cost included impact of lower maintenance activities due to COVID-19.

Growth Projects Development

The Oil & Gas business has a robust portfolio of infill development & enhanced oil recovery projects to add volumes in the near term and manage natural field decline. Some of key projects are:

Infill Projects

Mangala

Based on the success of the FM3 infill drilling campaign, opportunities to further accelerate production by drilling 4 horizontal wells and 1 vertical well in FM3 & FM5 sands were identified. The project also entails drilling of few deviated wells for FM2/3 sands and conversion of 3 wells to polymer injector.

As of March 31, 2022, drilling campaign of 5 wells is completed, of which 4 horizontal wells are hooked up.

Tight Oil (ABH)

Aishwariya Barmer hill stage II drilling program enabled to establish the confidence in reservoir understanding of ABH. Based on the success of it, drilling of 5 additional wells were conceptualised and drilling of which completed in fourth quarter of fiscal year 2022. Of these, 2 wells have been hooked up.

NI Infill

The project entails drilling, completion, and hook-up of 3 producer wells in the NI field. Drilling and hook up of 3 well campaign has been completed during fiscal year 2022.

Tight Gas (RDG)

In order to realise the full potential of the gas reservoir, an infill drilling campaign of 27 wells has commenced during fiscal year 2022. As of March 31, 2022, 6 wells have been drilled and they are being progressively hooked up to ramp up volumes.

Satellite Fields

In order to monetise the satellite fields, an integrated contract for the appraisal and development activity through global technology partnership has commenced. Till March 31, 2022, 14 wells have been drilled, of which 2 wells are hooked-up.

Offshore (Cambay)

Infill program in Cambay over the last few years has resulted in incremental recovery. New opportunities have been identified basis integration of advanced seismic characterisation, well and production data. Drilling commenced during third quarter of fiscal year 2022. As of March 31, 2022, 2 wells have been drilled of which 1 well is hooked-up

Discovered Small Field (DSF)

Hazarigaon: Well intervention and testing activities was carried out in Hazarigaon-1 well. Extended well testing and monetisation is under planning.

Exploration and Appraisal

Rajasthan - (BLOCK RJ-ON-90/1)

Rajasthan exploration

The Rajasthan portfolio provide access to multiple play types with oil in high permeability reservoirs, tight oil and tight gas. We have completed drilling of 3 exploration wells during fiscal year 2022. We also performed appraisal activities in Felsic (oil) zone in RDG and monetisation is under planning. We are also evaluating further opportunities to drill low to medium risk and medium to high reward exploration wells to build on the resource portfolio.

Open Acreage Licensing Policy (OALP)

Under the Open Acreage Licensing Policy (OALP), revenuesharing contracts have been signed for 51 blocks located primarily in established basins, including some optimally close to existing infrastructure.

Full Tensor Gravity Gradiometry™ (FTG) airborne survey for prioritising area of hydrocarbon prospectivity has been completed in Assam, Cambay, Rajasthan & Kutch region. Seismic acquisition program has been completed in Assam, Rajasthan, Cambay, and Offshore region.

15 wells exploration (risked resource potential of 122 mmboe) work program spread over Rajasthan, Cambay, and North-east with drilling cost of $118 million is under execution. Till March 31, 2022, 11 wells have been drilled (3 in Rajasthan, 6 in Cambay and 2 in North-east). Additional drilling, fraccing, and related preparation activities are ongoing in Rajasthan, Cambay, and North-east.

Till date three hydrocarbon discoveries have been notified under the OALP portfolio.

- Rajasthan (2 Discoveries): KW2-Updip-1 was notified as oil discovery and is under extended testing. Durga -1 notified as oil discovery during fiscal year 2022 and monetisation is under planning.

- Cambay (1 Discovery): Jaya-1 is a gas and condensate discovery, and monetisation is under planning.

Geophysical and geotechnical site survey is ongoing in Offshore region Drilling is expected to commence during first half of fiscal year 2023.

Strategic Priorities & Outlook

Vedanta’s Oil & Gas business has a robust portfolio mix comprising of exploration prospects spread across basins in India, development projects in the prolific producing blocks and stable operations which generate robust cash flows.

The key priority ahead is to deliver our commitments from our world class resources with ‘zero harm, zero waste and zero discharge:

- Infill projects across producing fields to add volume in near term

- Unlock the potential of the exploration portfolio comprising of OALP and PSC blocks

- Continue to operate at a low cost-base and generate free cash flow post-capex

Aluminium

THE YEAR IN BRIEF

In FY2022, the aluminium smelters achieved India’s highest production of 2.27 million tonnes. It has been a remarkable year as we inched towards our vision of 3 mtpa Aluminium. Though this year saw headwinds in cost due to rising commodity prices and the coal crisis, we undertook several structural initiatives to make our business immune from market induced volatilities. These reforms coupled with our continued focus on operational excellence, optimising our coal and bauxite mix, improved capacity utilisation across refinery, smelter and power plant, will further help reduce our cost in sustainable manner and make the business more predictable. and improving our price realisation to improve profitability in a sustainable manner through well-structured PMO approach. The hot metal cost of production for FY2022 stood at US$ 1,858 per tonne. We also achieved record production of 1.97 million tonnes at the alumina refinery through continued debottlenecking.

Occupational health & safety

We report with deep regret, five fatalities of business partner employees during the year at our Aluminum business, two each at Lanjigarh project site and at Jharsuguda and one at BALCO. We have thoroughly investigated all the five incidents and the lessons learned were shared across all our businesses to prevent such incidents in future.

This year, we experienced total 30 Lost Time Injuries (LTIs) resulting in LTIFR of 0.41 at our operations.

We conducted safety stand-downs across the sites to communicate the learnings from safety incidents and prevent repeated future incidents. Our safety leadership regularly engages with the business partner site in-charges and their safety officers for their capability development and strengthening the culture of safety at our sites. We follow a zero-tolerance policy towards any safety related violations with stringent consequence management.

To enhance competencies of our executives, engineers, and supervisors of business partners and inculcate culture of Safety, we have engaged DuPont Safety Solutions. The initiative is known as Sankalp – demonstrates our resolve to provide Safe and Healthy workplace to all our employees. Under this initiative the unit Leadership are trained to provide visible felt leadership and lead effective safety interactions with the employees. Safety Committees are formed across the business to drive and review safety performance across the business. Training is being given in various areas of safety to improve the safety culture. Visible felt leadership is core to our operations and all leaders are expected to demonstrate highest level of safety discipline in their respective areas of operations ensuring inclusivity of Business Partners as well.

To build a culture of CARE, a new initiative of assigning 10 to 15 business partner employees to an executive, who will work with them to drive safe behavior and eliminating unsafe practices has been implemented. This is an attempt / opportunity to solidify the relations between workers and executive.

Environment

During the year, Jharsuguda has recycled 11.5% of the water used, while BALCO has recycled 10.6%.

Our specific water consumption at VLJ metal was 0.39 m3/t, BALCO metal was 0.54 m3/t and alumina refinery was 1.90 m3/t.

Several Projects are being taken in water conservation to increase the amount of recycled water at each of our location. Reverse Osmosis plant has been commissioned at JSG thermal power plant to recycle water.

EV vehicles will be used in operations as part of the green drive. Under this initiative, the Jharsuguda unit has signed a contract to use 23 Electrical forklift instead of dieselbased forklift. We have planned to shift to 100 % EV LMV by FY 30. This will help us eliminate our in-plant scope 3 GHG emission from LMV operations at the Jharsuguda business.

This year we launched our low carbon aluminium brand, Restora, manufactured using Renewable energy through our two product lines – Restora and Restora Ultra. GHG emission intensity for these product lines are about half the global threshold for low carbon aluminium. A Strong step towards our commitment to achieve GHG emission intensity reduction of 25% by 2030 and Net zero carbon by 2050.

Restora Ultra is an ultra-low carbon aluminium brand in collaboration with Runaya Refining. Near zero carbon footprint – one of the lowest in the world. Testament to our focus on ‘zero waste’ through operational efficiencies and recovery from dross.

In the current fiscal year, we have reduced our GHG emission intensity by about 8.2% compared to the FY2021 baseline.

Management of hazardous waste such as spent Pot line, aluminium dross, and high volume low toxic waste such as fly ash, red mud etc. are material waste management issues for the aluminium business.

During the year, our operations have utilised 120% of Ash and 102% Dross. Ash is being utilised in partnership with NHAI and cement companies as part of circular economy model. JSG operations is supplying fly ash for highway construction activities in and around Odisha as part of partnership with NHAI. This partnership aims at creating a connected economy aligned to our vision of creating a cleaner, greener and sustainable tomorrow. BALCO is associated with Cement inhdustries in the vicinity through road mode and striving to achieve economies of scale and enterprise solution which is environmentally friendly and cost effective. For the very purpose, BALCO has ventured into supplying the conditioned Fly Ash through Rake.

This meaningful, sustainable increase in fly ash utilisation at locational, distant thermal power plant is mutual win for both Cement companies and BALCO. BALCO is also engaged in Mine back filling of Manikpur Mines which will further support the effort to utilise Fly Ash. Our Lanigarh operation has placed an order for manufacturing of red mud bricks. It is in the direction of waste-to-wealth initiative. On similar lines, JSG unit is working with Runaya refining for extracting valuable metals from Dross as part of waste-towealth initiatives.

The organisation is working proactively towards the vision of Zero Waste.

PRODUCTION PERFORMANCE

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Production (kt) | |||

| Alumina – Lanjigarh | 1,968 | 1,841 | 7% |

| Total aluminium production | 2,268 | 1,969 | 15% |

| Jharsuguda | 1,687 | 1400 | 20% |

| BALCO | 582 | 570 | 2% |

Alumina refinery: Lanjigarh

At Lanjigarh, production was 7% higher y-o-y at 1.97 million tonnes, primarily through continued plant debottlenecking and improved capacity utilisation.

Aluminium smelters

We ended the year with all time high production of 2.27 million tonnes. Our smelter at BALCO continued to show consistent performance.

Coal Security

We continue to focus on the long-term security of our coal supply at competitive prices. We added Jamkhani (2.6 mtpa), Radhikapur (West) ;(6 mtpa) and Kuraloi (A) North (8 mtpa) coal mines through competitive bidding process by GOI. We intend to operationalise Jamkhani and Radhikapur (West) in the next fiscal year. These acquisitions, along with 15 million tons of long-term linkage will ensure 100% coal security for Aluminium Business. We also look forward to continuing our participation in linkage coal auctions and secure coal at competitive rates.

PRICES

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Average LME cash settlement prices (US$ per tonne) | 2,774 | 1,805 | 54% |

Average LME prices for aluminium in FY2022 stood at US$ 2,774 per tonne, 54% higher y-o-y. The LME aluminium price has seen a wild swing this year, especially in the last quarter owing to both supply and demand side disruptions. Post the covid resurgence, the aluminium market is in a growth phase now with dedicated focus to accelerate development and reached to pre covid levels. This demand growth is expected to increase from 68 million tons to 75 million tons by 2025 driven by sunrise sectors such as Electric Vehicle, Renewable Energy, Défense and Aerospace. On supply side, during Q2 & Q3 FY2022, the energy price skyrocketed due to closure of coal mines in China, exceptionally higher demand for oil and closure of oil refinery in the east coast of Americas. Pertaining to exceptionally higher energy prices, several European smelters closed during the FY2022 causing a deficit of ~1.5 million tonnes in CY21. The deficit is expected to intensify with the ongoing geopolitical situation and continued high energy prices in CY22. FY2022 also witnessed demand growth stabilisation around the world.

UNIT COSTS

(US$ per tonne)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Alumina cost (ex-Lanjigarh) | 291 | 232 | 24% |

| Aluminium hot metal production cost | 1,858 | 1,347 | 38% |

| Jharsuguda CoP | 1,839 | 1,304 | 41% |

| BALCO CoP | 1,913 | 1,450 | 32% |

During FY2022, the cost of production (CoP) of alumina increased to US$ 291 per tonne, due to headwinds in the input commodity prices, partially offset via benefits from increase in locally sourced bauxite, continued debottlenecking and improved capacity utilisation

In FY2022, the total bauxite requirement of about 5.8 million tonnes were met through domestic as well as import sources. ~63% of the Bauxite requirement was catered from Odisha through our LTC with the Government of Odisha and remaining 37% through imports from LTC with a reputed supplier.

In FY2022, the CoP of hot metal at Jharsuguda was US$ 1,839 per tonne, increase by 41% from US$ 1,304 in FY2021. The hot metal CoP at BALCO stood at US$ 1,913 per tonne, increase by 32% from US$ 1,450 per tonne in FY2021. This was primarily driven by the headwinds in commodity prices and reduced materialisation of domestic coal from Coal India Limited (CIL) with higher auction premiums.

FINANCIAL PERFORMANCE

(₹ crore, unless stated)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Revenue | 50,881 | 28,644 | 78% |

| EBITDA | 17,337 | 7,751 | 124% |

| EBITDA margin | 34% | 27% |

Strategic priorities & outlook

With the primary aluminium demand expected to increase and the ongoing geopolitical issues, the outlook for FY2023 is strong. European premiums are soaring while US premiums are supported by high demand and low stocks. The deficit is expected to intensify in 2022.

The input commodity prices across carbon are moving on a higher side driven by continued demand increases. We are looking at ways to continuously optimise our costs, while also increasing the price realisation to improve profitability sustainably.

India’s market is expected to have robust growth, supported primarily by growing industrial activity and government focus on infrastructure sector and domestic manufacturing in the country. Several government initiatives (Make in India, Production-linked Incentive for domestic manufacturing, National Infrastructure Pipeline and National Rail Plan) will enhance aluminium demand, going forward.

Vedanta continues to expand its value-added product portfolio in line with evolving market demand, making it poised to grow in the Indian aluminium market.

At our power plants, we are also working towards improving materialisation from CIL, reducing gross calorific value (GCV) losses in coal as well as improving plant operating parameters which should deliver higher plant load factors (PLFs) and a reduction in non-coal costs. Vedanta is working out a plan to expediate operationalisation of Jamkhani, Radhikapur and Kuraloi coal mines.

Whilst the current market outlook remains bullish, our core strategic priorities include:

- ESG: Focus on the health & safety of our employees, business partners, customers, and community

- Asser Optimisation: Deliver alumina and aluminium production through structured asset optimisation frameworky

- Growth: Complete Lanjigarh Expansion, Expedite Value Added Product Projects

- Raw Material Security: Enhance bauxite and alumina security through LTCs and new mines auctions.

- Coal security: Expedite operationalisation of Jamkhani, Radhikapur and Kuraloi coal block, improve linkage coal materialisation

- Quality: Zero slippage in quality in entire value chain

- Operational Excellence: Improve our plant operating parameters across locations; and

- Product Portfolio: Improve realisations by enhancing our value-added product portfolio

During the year, revenue increased by 78% to ₹50,881 crore, driven primarily by rising LME Aluminium prices and higher production volumes. EBITDA was significantly up at ₹17,337 crore (FY2021: ₹7,751 crore), mainly due to improved hot metal cost of production & increased sales realisation.

Power

THE YEAR IN BRIEF

In FY2022, TSPL’s (Talwandi Sabo Power Limited) plant availability was 76% and Plant Load Factor (PLF) was 51%.

Occupational health & safety

In FY2022 TSPL focus on Category 5 Safety Incident elimination such as Critical Risk management, Catastrophic Risk Management, Horizontal deployment of Safety alert learnings, Vedanta Safety Standard Implementation and Engineering / Controls such as Line of Fire Prevention and Safety improvement project.

We continue to strengthen the ’Visible Felt Leadership ‘through the on-ground presence of senior management, improvement in reporting across all risk and verification of on-ground critical controls. We also continue to build safety assisting infrastructure development through the construction of pedestrian pathways, dedicated route for bulkers, creation of secondary containment for hazardous chemicals and other infra development across sites.

Environment

TSPL focus on environment protection measures such as maintaining green cover of over 800 acres, continue the expansion of green cover inside plant premises and nearby communities. TSPL ensure availability of environment protection system such as ESP, Fabric Filters, water treatment plant and RO Plant. In Tailing Dam Management, TSPL has implemented all the recommendation of M/s Golder associates for ash dyke. Additional desk top review of TSPL Ash Dyke Facility by ATC Williams, Australia & TATA Consultancy (TCE) as Engineer of Records (EOR) to ensure Ash Dyke stability to review dyke design, quality assurance during for ash dyke raising and quarterly audit of ash dyke facility. In FY2022, TSPL achieved 91% Ash utilisation in Road Construction, in Building sector for bricks, blocks, cements and low-lying area filling. TSPL has signed various MOUs with stakeholders to increase ash utilisation.

TSPL has recycled 16.7% of the water used & Reduce the Fresh water consumption by various operation controls. TSPL continue its focus on energy saving projects such as CWP RPM reduction, HPT performance improvement, replacement of conventional lighting fixtures with LED lighting fixtures.

To stimulate efforts and reach towards new heights of sustainable business practices, TSPL established ESG transformation office. Under this initiative, TSPL has accelerated its efforts in Environment, Social and Governance aspects. TSPL ESG Transformation Office was created which included 12 communities of practice from each aspect of sustainability. Communities of Practice included Carbon, Water, Waste, Biodiversity, Supply chain, People, Communities (CSR), communication, Safety and Health, Acquisitions, Expansions. Each Community is led by a senior leader in the concerned department. Each community is driving sustainability initiatives in their community. In FY2021-22, total 55 projects are identified, and improvement initiatives works are in progress.

PRODUCTION PERFORMANCE

(US$ per tonne)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Total power sales (MU) | 11,872 | 11,261 | 5% |

| Jharsuguda 600 MW | 2,060 | 2,835 | (27%) |

| BALCO 300 MW* | 1,139 | 1,596 | (29%) |

| MALCO# | - | - | - |

| HZL wind power | 414 | 351 | 18% |

| TSPL | 8,259 | 6,479 | 28% |

| TSPL – availability | 76% | 81% |

# Continues to be under care and maintenance since 26 May 2017 due to low demand in Southern India.

* We have received an order dated 01 Jan 2019 from CSERC for Conversion of 300MW IPP to CPP w.e.f. 01 April 2017. During the Q4 FY2019, 184 units were sold externally from this plant.

Operations

During FY2022, power sales were 11,872 million units, 5% higher y-o-y. Power sales at TSPL were 8,259 million units with 76% availability in FY2022. At TSPL, the Power Purchase Agreement with the Punjab State Electricity Board compensates us based on the availability of the plant.

The 600MW Jharsuguda power plant operated at a lower plant load factor (PLF) of 53% in FY2022.

The 300 MW BALCO IPP operated at a PLF of 63% in FY2022.

The MALCO plant continues to be under care and maintenance, effective from 26 May 2017, due to low demand in Southern India.

UNIT SALES AND COSTS

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Sales realisation (₹/kWh)1 | 3.10 | 3.09 | - |

| Cost of production (₹/kWh)1 | 2.42 | 2.34 | 3% |

| TSPL sales realisation (₹/kWh)2 | 3.62 | 2.96 | 22% |

| TSPL cost of production (₹/kWh)2 | 2.76 | 2.10 | 31% |

(1) Power generation excluding TSPL

(2) TSPL sales realisation and cost of production is considered above, based on availability declared during the respective period

Average power sale prices, excluding TSPL, remained flat and the average generation cost was marginally higher at ₹2.4 per kWh (FY2021: ₹2.3 per kWh).

In FY2022, TSPL’s average sales price was lower at ₹3.6 per kWh (FY2021: ₹3 per kWh), and power generation cost was higher at ₹2.8 per kWh (FY2021: ₹2.1 per kWh).

FINANCIAL PERFORMANCE

(₹ crore, unless stated)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Revenue | 5,826 | 5,375 | 8% |

| EBITDA | 1,082 | 1,407 | (23%) |

| EBITDA margin | 19% | 26% |

* Excluding one-offs

EBITDA for the year was 23% lower y-o-y at ₹1,082 crore from ₹1,407 crore.

Strategic priorities & outlook

During FY2023, we will remain focused on maintaining the plant availability of TSPL and achieving higher pant load factors at the BALCO and Jharsuguda IPPs.

Our focus and priorities will be to:

- Resolve pending legal issues and recover aged power debtors;

- Achieve higher PLFs for the Jharsuguda and BALCO IPP; and

- Improve power plant operating parameters to deliver higher PLFs/availability and reduce the non-coal cost

Ensuring safe operations, energy & carbon management

Iron Ore

THE YEAR IN BRIEF

Production of Crude ore at Karnataka stood at 5.60 wet million tons. With the order of Central Empowered Committee (Supreme Court appointed body) on 21st March’20, our annual mining capacity has been increased up to 5.89 mtpa. In line with this the Govt. of Karnataka on Feb’2021 has allocated the production quantity of 5.60 wet million tons from FY2021 onwards to maintain the SC allocated district cap

Meanwhile, operations in Goa remained in suspension in FY2021 due to a state-wide directive from the Supreme Court. However, we continue to engage with the Government to secure a resumption of mining operations.

Occupational health & safety

With our vision towards the of Zero Harm we are committed to achieve zero fatal accident at Iron ore Business. Our Lost Time Injury Frequency Rate (LTIFR) is 0.85 compared to 0.56 (FY2021). We are now focusing on bringing down the number of Injuries by conducting a detailed review of critical risk controls through critical task audits, strengthening our work permit and isolation system through identification and closure of gaps, on site audits, increasing awareness of both Company and business personnel by conducting trainings as per requirements considering the sustainability framework.

We have strived to enhance the health and safety performance by digitalisation initiatives such as COVID Marshalls, usage of non-contact type voltage detectors, underground cable detectors, usage of AI cameras for spotting safety violations etc. Currently we are working on implementing virtual reality training for our manpower in areas such as safety performance standards, hazards, risk control measures, and best practices in the field of Safety. We are also considering the possibility of implementing geo fencing so as to achieve better access control at various locations across the plant.

design and implementation of the same as per Vedanta Safety Standards. At VAB we have conducted a training on crane and lifting safety through a third party so as to authorise a shortlisted group of competent personnel for approving critical lift plan and better focus on safety in areas of lifting and critical lifts.

In addition to employees nominated as safety stewards we also conducting training on NEBOSH and IOSH for shortlisted Vedanta personnel from departments such as Operation, Maintenance and Environment.

In FY 2023 we will be further strengthening our Fatality Prevention Programme and also improving our safety management system through cross business audits.

In order to achieve highest levels of safety at site we have identified key personnel from operation and maintenance to serve as safety stewards in addition to their current roles and responsibilities. Those who are nominated as safety stewards have been made to pursue a distance Masters degree in safety from reputed universities from the country which will enable them to identify and rectify issues at site using sophisticated tools.

Environment

At our Value-Added Business we recycle and reuse almost all the wastewater. Only the non-contact type condenser cooling water of the power plant is cooled and treated for pH adjustment and discharged back into the Mandovi river, which is a consented activity by the authorities.

8500 numbers of plantation were done in the year 2021-22, including 7500 numbers of plantation through Miyawaki method.

Also, Value Added Business received Environmental Clearance for expansion project for installing Ductile Iron plant, oxygen plant & Ferro Silicon Plant along with increasing hot metal production capacity

At Iron ore Karnataka, continuing with its best practises, company has constructed 38 check dams, 7 settling pond and 2 Harvesting pits. Additionally, company has de-silted 6 nearby village ponds increasing their rainwater harvesting potential by 60000 m3/annum.

In FY2022, around 18 Ha of mining dump slope was covered with biodegradable geotextiles to prevent soil erosion & 45,000 native species sapling were planted. Various latest technologies like use of fog guns; environment friendly dust suppressants mixed with water were adopted on the mines to reduce water consumption for dust suppression without affecting the effectiveness of the measures.

Awards and accolades

For the year FY2022 various IOB units have received awards for their performance in Health and Safety such as Green Triangle Safety Award by Factories & Boilers for VAB, Apex India Gold Award for Safe Work Place Management and Apex India Green Leaf Award for Environment Excellence for Also our Sanquelim mine won Platinum award for Best environment Practises from International Conference on Geotechnical Challenges in mining , Tunneling and Underground Structures, 2021.

PRODUCTION PERFORMANCE

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

| Production (dmt) | |||

| Saleable ore | 5.4 | 5.0 | 8% |

| Goa | - | - | - |

| Karnataka | 5.4 | 5.0 | 8% |

| Pig iron (kt) | 790 | 596 | 33% |

| Sales (dmt) | |||

| Iron ore | 6.8 | 6.5 | 4% |

| Goa | 1.1 | 2.1 | (50%) |

| Karnataka | 5.7 | 4.4 | 30% |

| Pig iron (kt) | 790 | 609 | 30% |

Operations

At Karnataka, production was 5.4 million tonnes, 8% higher y-o-y. Sales in FY2022 were 5.7 million tonnes, 30% higher y-o-y due to Covid-19 Impact in the previous financial year. Production of pig iron was 789,717 tonnes in FY2022, higher by 30% y-o-y due to Covid-19 Impact in previous year and efficiency improvement post relining.

At Goa, mining was brought to a halt pursuant to the Supreme Court judgement dated 7 February 2018 directing all companies in Goa to stop mining operations with effect from 16 March 2018. We continue to engage with the Government for a resumption of mining operations.

We bought low grade iron ore in auctions held by Goa Government in Auction No -25, 26 & 27. This ore along with opening stock of ore purchased in 23rd & 24th auction and fresh royalty paid ore moved out of mines post the supreme court order, was then beneficiated and around 1.1 million tonnes were exported which further helped us to cover our fixed cost and some ore were used to cater to requirement of our pig iron plant at Amona.

FINANCIAL PERFORMANCE

(₹ crore, unless stated)

| Particulars | FY2022 | FY2022 | % Change |

|---|---|---|---|

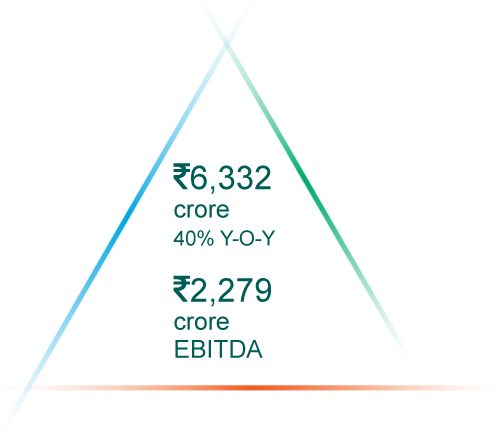

| Revenue | 6,350 | 4,528 | 40% |

| EBITDA | 2,280 | 1,804 | 26% |

| EBITDA margin | 36% | 40% |

In FY2022, revenue increased to `6,350 crore, 40% higher y-o-y mainly due to increase in sales volume at Karnataka & VAB and higher realisations at Karnataka & VAB during the year. EBITDA increased to `2,280 crore compared with `1804 crore in FY2021 was mainly due to improved margin at Karnataka and higher volume at Karnataka & VAB.

Strategic priorities & outlook

Our near-term priorities comprise:

- Resume mining operations in Goa through continuous engagement with the government and the judiciary

- Realign and revamp resources, assets, HEMM’s for starting the mine’s operation

- Grow our footprint in iron ore by continuing to participate in auctions across the country, including Jharkhand.

- Advocacy for removal of E-auction/trade b

Steel

THE YEAR IN BRIEF

ESL is an integrated steel plant (ISP) in Bokaro, Jharkhand, with a design capacity of 2.5mtpa. Its current operating capacity is 1.5mtpa with a diversified product mix of Wire Rod, Rebar, DI Pipe and Pig Iron. This year business has achieved highest ever hot metal production of 1,355kt, since acquisition.

In FY2022, ESL Steel Limited (ESL) has achieved highest ever NSR during the year since acquisition resulting in favorable EBITDA margin of US$74 per tonne.

Occupational health & safety

We had one unfortunate incident in the month of September where we had lost 3 of our business partners while carrying out a job on lift. A detailed investigation was carried out by cross business experts and actions implemented in letter and spirit. The current LTIFR for FY2022 is 0.80.

As part of our safety culture transformation journey, we had come up with various safety initiatives to enhance our safety performance.

Given below are few of the significant initiatives:

- Project Prarambhik: We have engaged DuPont Sustainable Solutions in our safety transformation journey with key focus on safety interactions and people engagement in executing safe operational practices

- Safety Park: An on-site demonstration facility for trainings on various VSS Standards developed with prototypes for better understanding

- AR/VR: Virtual Reality technology used for safety trainings to place the employees and business partners in the work environment and build their capability before actually placing them in the workplace

- Safety Portals: Introduced various safety portals-Safety Interaction portal, Incident Management portal, mQuiz Portal, Safety Projects portal to provide user friendly platforms to capture various leading indicators of safety promoting a better workplace

- CCTV cameras with AI detection technology

- NDO: Night Duty Officer concept initiated where senior leaders are engaged in night duties for better vigilance round the clock on observations

- Joint Safety Walks: Site leadership team visits each shop/floor on every Saturday to have a site walkthrough survey and conducts safety interactions to identify gaps and handhold the team in mitigating the risks

- Surakshavahan: A mobile safety van concept to provide on job safety training to business partners and employees with audio visual facility for effective training with maximum engagement

- Theme based campaigns: Every month we select one safety standard as a theme and drive various awareness initiatives and competitions including trainings and webinars along with quick wins