Finance Review

Executive summary

We had a strong operational and financial performance in FY2022 amidst the challenges faced due to the pandemic. We continue to focus on controllable factors such as resetting cost base through diverse cost optimisation initiatives, disciplined capital investments, working capital initiatives, marketing initiatives and volume with strong control measures to ensure safe operations across businesses within framed government and corporate guidelines amidst the pandemic.

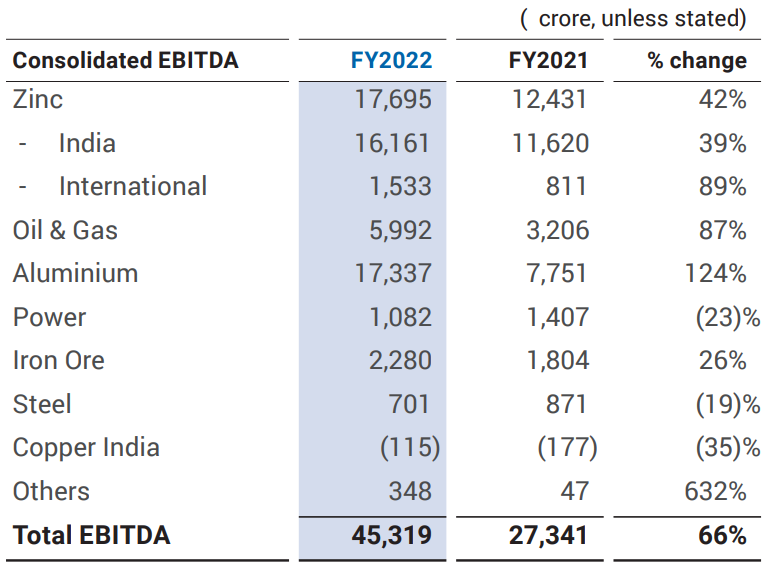

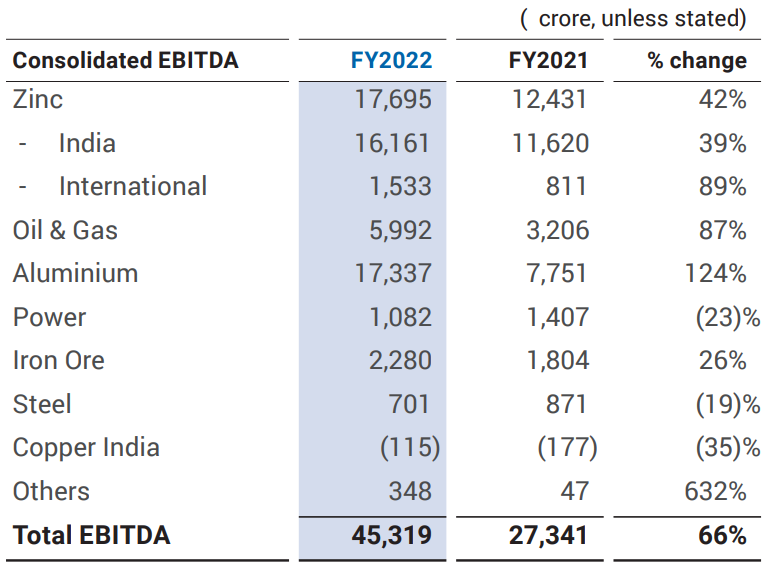

In FY2022, we recorded an EBITDA of ₹45,319 crore, 66% higher y-o-y and robust adjusted EBITDA margin1 of 39%. (FY2021: ₹27,341 crore, margin 36%).

Higher sales volumes resulted in increase in EBITDA by ₹1,578 crore, driven by higher volumes at Aluminium, Zinc International and Iron ore business.

Market factors resulted in increase in EBITDA by ₹18,142 crore. This was primarily driven by increase in the commodity prices, rupee depreciation, partially offset by input inflation and change in Profit Petroleum Tranche.

Gross debt as on 31 March 2022 was ₹53,109 crore, a decrease of ₹3,919 crore since 31 March 2021. This was mainly due to the repayment of debt at HZL, BALCO and CIHL partially offset by increase in borrowing at Vedanta Standalone.

Net debt as on 31 March 2022 was ₹20,979 crore, decreased by ₹ 3,435 crore since 31 March 2021 (FY2021: ₹24,414 crore), majorly on account of cash flow from operations, partially offset by payment of dividend and capex payment. The balance sheet of Vedanta Limited continues to remain strong with cash & cash equivalents, of ₹32,130 crore and Net Debt to EBITDA ratio at 0.5x (FY2021: 0.9x).

1 Excludes custom smelting at Copper India.Consolidated EBITDA

EBITDA increased by 66% in FY2022 to ₹45,319 crore. This was mainly driven by higher commodity prices, higher sales realisation from Iron ore and Steel business, increased volumes at Zinc International and Aluminium business, and rupee depreciation, partially offset by input inflation and change in Profit Petroleum Tranche.

Consolidated EBITDA bridge

-

Prices, premium/discount

Commodity price fluctuations have a significant impact on the Group’s business. During FY2022, we saw a net positive impact of ₹27,973 crore on EBITDA due to commodity price fluctuations.

Zinc, lead and silver: Average zinc LME prices during FY2022 increased significantly to US$3,257 per tonne, up 34% y-o-y; lead LME prices decreased to US$2,285 per tonne, up 22% y-o-y; and silver prices increased to US$24.6 per ounce, up 7% y-o-y. The cumulative impact of these price fluctuations increased EBITDA by ₹5,880 crore.

Aluminium: Average aluminium LME prices increased to US$2,774 per tonne in FY2022, up 54% y o y, this had a positive impact of ₹15,795 crore on EBITDA.

Oil & Gas: The average Brent price for the year was US$81.1 per barrel, up 82% y-o-y. This had positive impact on EBITDA by ₹3,231 crore.

Iron & Steel: Higher realisations positively impacted EBITDA at ESL by ₹1,650 crore and IOB by ₹1,199 crore

-

Direct raw material inflation

Prices of key raw materials such as imported alumina, thermal coal, carbon and caustic have increased in FY2022, negatively impacting EBITDA by ₹9,127 crore, primarily at Aluminium, Zinc and Iron & Steel business.

-

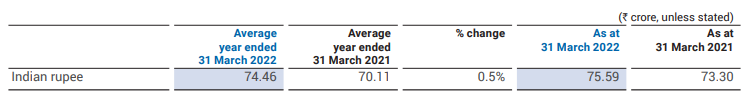

Foreign exchange fluctuation

INR depreciated against the US dollar during FY2022. Stronger dollar is favourable to the Group’s EBITDA, given the local cost base and predominantly US dollar-linked pricing. The favourable currency movements positively impacted EBITDA by ₹105 crore.

Key exchange rates against the US dollar:

-

Profit petroleum to GOI at Oil & Gas

The profit petroleum outflow to the Government of India (GOI), as per the production sharing contract (PSC), increased by ₹788 crore.

-

Regulatory

During FY2022, changes in regulatory levies such as Renewable Power Obligation etc. had a cumulative positive impact on the Group EBITDA of ₹21 crore.

-

Volumes

Higher volume led to increase in EBITDA by ₹1,578 crore in the following businesses:

Aluminium (positive K1,138 crore)

In FY2021, the Aluminium business achieved metal sales of 2.26 million tonnes, up 15% y-o-y. This volume increase had a positive impact on EBITDA of ₹1,138 crore.

FACOR (positive K213 crore)

Increased EBITDA driven by increase in sales volumes at FACOR.

Zinc International (positive K112 crore)

Sales volume increased at Gamsberg mine

-

Cost and marketing

Higher costs resulted in decrease in EBITDA by ₹2,622 crore over FY2022, primarily due to increased cost, partially offset by higher premia realisations at Aluminium and Zinc business.

-

Others

This primarily includes the impact of higher capex and opex recovery in the Oil & Gas business, inventory and foreign exchange adjustments during FY2022 partially offset by lower power EBITDA, impacting EBITDA positively by ₹880 crore.

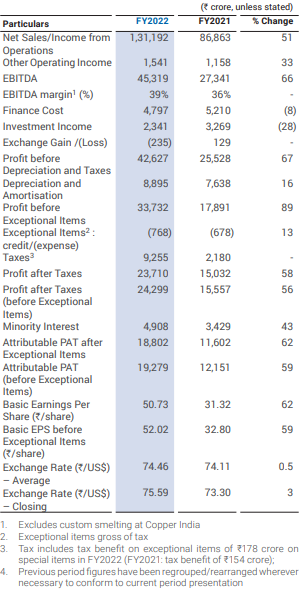

INCOME STATEMENT

Revenue

Revenue for the year was ₹131,192 crore, higher 51% y-o-y. This was driven by higher commodity prices, higher volumes at Aluminium business, Copper, TSPL, Iron Ore and, FACOR, increase in premium in aliminium and zinc and rupee depreciation.

EBITDA and EBITDA margin

EBITDA for the year was ₹45,319 crore, 66% higher y-o-y. This was mainly driven by higher commodity prices, higher sales realisation from Iron ore and Steel business, increased volumes at Zinc International and Aluminium business, and rupee depreciation; partially offset by input inflation and change in Profit Petroleum Tranche. We maintained a robust adjusted EBITDA margin1 of 39% for the year (FY2021: 36%).

Depreciation and amortisations

Depreciation for the year was ₹8,895 crore compared to ₹7,638 crore in FY2021, higher by 16%, primarily on account of higher ore production in Zinc business, higher depletion at Oil & Gas business and capitalisation at Aluminium business.

Net interest

The blended cost of borrowings was 7.9% for FY2022 compared to 7.7% in FY2021.

Finance cost for FY2022 was ₹4,797 crore, 8% lower compared to ₹5,210 crore in FY2021 mainly on account of decrease in average borrowings, and marginal decrease in blended cost of borrowings.

Investment income for FY2022 stood at ₹2,341 crore, 28% lower compared to ₹3,269 crore in FY2021. This was mainly due to Mark to Market movement and change in investment mix.

Exceptional items

The exceptional items for FY2022 was at negative ₹ 769 crore, mainly on account of exploration write off in Oil & Gas business, provision against KCM receivables, fly ash disposal at Aluminium, partially offset by impairment reversal in Oil & Gas business.

[For more information, refer note [34] set out in P&L notes of the financial statement on exceptional items].

Taxation

Tax expense for FY2022 stood at `9,255 crore (FY2021: `2,180 crore). The normalised ETR is 28% (excluding tax on exceptional items of `178 crore and DTA reversal on ESL losses of `122 crore) compared to the normalised ETR of 27% (excluding tax on exceptional items `154 crore, tax on dividend from HZL `869 crore, new tax regime impact `(271) crore and Deferred Tax Asset of `3,111 crore recognised on losses in ESL).

1 Excludes custom smelting at Copper India.

Attributable profit after tax (before exceptional items)

Attributable PAT before exceptional items was ₹19,279 crore in FY2022 compared to ₹12,151 in FY2021.

Earnings per share

Earnings per share before exceptional items for FY2022 were ₹52.02 per share as compared to ₹32.80 per share in FY2021.

Dividend

The Board has declared a total dividend of ₹45 per share during the year.

Shareholders fund

Total shareholders fund as on 31 March 2022 aggregated to `65,383 crore as compared to `62,278 crore as of 31 March 2021. This was primarily net profit attributable to equity holders earned during the year partially offset by dividend paid during the year.

Net fixed assets

The net fixed assets as on 31 March 2022 were ₹1,09,345 crore. This comprises ₹14,230 crore as capital work-inprogress.

Balance Sheet

Our financial position remains strong with cash and liquid investments of ₹32,130 crore.

The Company follows a Board approved investment policy and invests in high quality debt instruments with mutual funds, bonds and fixed deposits with banks. The portfolio is rated by CRISIL, which has assigned a rating of Tier 1 (meaning highest safety) to our portfolio Further, the Company has undrawn fund based committed facilities of c.`6,800 crore as on 31 March 2022.

Gross debt as on 31 March 2022 was `53,109 crore, a decrease of `3,919 crore since March 31, 2021. This was mainly due to the repayment of debt at HZL, BALCO and CIHL partially offset by increase in borrowing at Vedanta Standalone.

Gross Debt comprises term debt of c.`46,400 crore, working capital loan of c.`1,600 crore and short-term borrowing of c. `5,100crore. The loan in INR currency is 91% and balance 9% in foreign currency. Average debt maturity of term debt is c. 3.4 years as of 31 March 2022.

CRISIL and India Ratings revised the rating of Vedanta from AA- to AA with Stable Outlook in FY2022