Adhere to global business standards of corporate governance

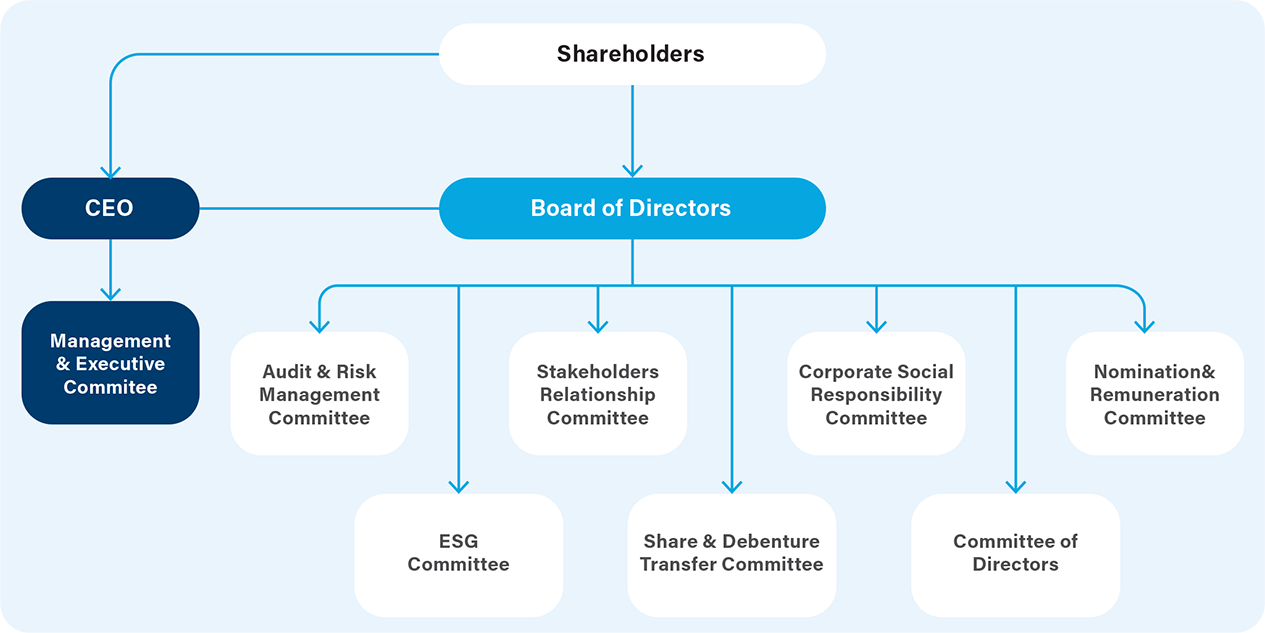

We believe sound corporate governance is the bedrock of a sustainable and commercially successful business. It helps us meet our strategic goals responsibly and transparently, while being accountable to our stakeholders. A robust governance structure upholds global best practices, preserves the interests of stakeholders and ensures the integrity of the information that goes out to them.

Key material issues

Compliance to government regulations

Ethical business practices

Governance for sustainability

Risk management

SDGs impacted

Sub-goals8.7: Take immediate and effective measures to eradicate forced

labour, end modern slavery and human trafficking and secure the

prohibition and elimination of the worst forms of child labour, including

recruitment and use of child soldiers, and by 2025 end child labour in

all its forms

16.7: Develop effective, accountable and transparent institutions at

all levels