ENTERPRISE RISK MANAGEMENT

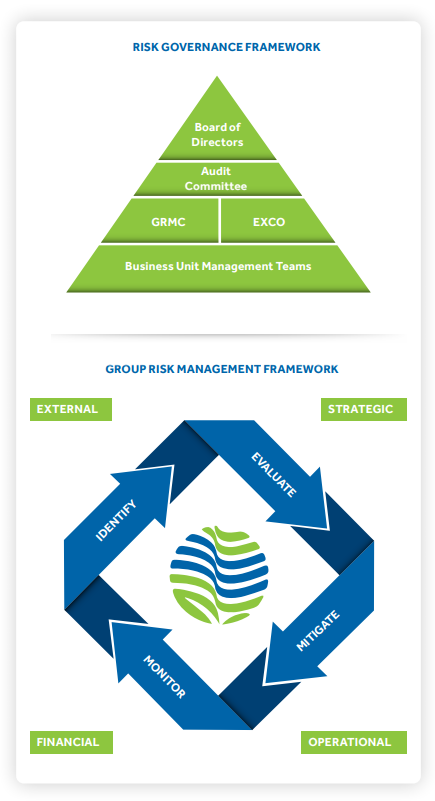

The Group has a multi-layered

risk-management framework that

aims to effectively manage the risks

that our businesses are exposed to

in the course of their operations,

as well as in their strategic actions.

We identify risks at the individual

business level for existing operations

as well as for ongoing projects

through a well-crafted methodology.

Formal discussion on risk

management takes place at business

level review meetings at least once

in a quarter. Every business division

of the Group has evolved its own risk

matrix, which gets reviewed by the

Business Management Committee.

In addition, business divisions have

developed their own risk registers.

Respective businesses review the

risks, changes in the nature and

extent of major risks since the last

assessment, control measures and

further action plans. The control

measures stated in the risk matrix

are also periodically reviewed by

the business management teams

to verify their effectiveness. These

meetings are chaired by the businessCEOs and attended by CXOs, senior

management and functional heads

concerned. The role of risk officers

at each business and at the Group

level is to create awareness on

risks at the senior management

level, and to develop and nurture a

risk-management culture within the

businesses. The Company’s

risk-mitigation plans are integral to

the KRAs / KPIs of process owners.

The governance of risk management

framework in the businesses is

anchored with the leadership teams.

The Audit & Risk Management

Committee aids the Board in the

risk management process through

identification and assessment

of any changes in risk exposure,

review of risk-control measures

and by approval of remedial

actions, wherever appropriate. The

Committee is, in turn, supported

by the Group Risk Management

Committee, which helps the Audit

& Risk Management Committee in

evaluating the design and operating

effectiveness of the risk-mitigation

programme and the control systems.

The Risk Management Committee

meets at least four times annually

to discuss risks and mitigation

measures. The Committee reviews

the robustness of our framework at

individual businesses and progress

against actions planned for key risks.

Our risk-management framework

is simple and consistent and

provide clarity on managing and

reporting risks to our Board.

Together, our management systems,

organisational structures, processes,

standards and code of conduct

and ethics represent the system of

internal control that governs how

the Group conducts its business and

manages the associated risks.

The Board shoulders the ultimate

responsibility for the management

of risks and for ensuring the

effectiveness of internal control

systems. It includes the Audit

Committee’s report on the risk

matrix, significant risks, and

mitigating actions that we have put

in place. Any systemic weaknesses

identified by the review areaddressed by enhanced procedures

to strengthen the relevant controls,

and these are reviewed regularly.

The Audit Committee is, in turn,

assisted by the Group-level

Risk Management Committee

in evaluating the design and

effectiveness of the risk-mitigation

programme and control systems.

The Group Risk Management

Committee (GRMC) meets every

quarter and comprises the Group

Chief Executive Officer, Group

Chief Financial Officer and DirectorManagement Assurance. The Group

Head-Health, Safety, Environment

& Sustainability is invited to attend

these meetings. GRMC discusses

key events impacting the risk profile,

relevant risks and uncertainties,

emerging risks and progress against

planned actions.

Since it is critical to the delivery of

the Group’s strategic objectives,

risk management is embedded in

business-critical activities, functions

and processes. The risk management

framework helps the Company by

aligning operating controls with the

Group’s objectives. It is designed to

manage rather than eliminate therisk of failure to achieve business

objectives and provides reasonable

and not absolute assurance against

material misstatement or loss.

Materiality and risk tolerance are

key considerations in our decisionmaking. The responsibility for

identifying and managing risks lies

with every manager and business

leader.

Additionally, other key risk governance and oversight committees in the Group comprise the following:

Additionally, there are various Group

level Management Committees

(ManComs) such as Procurement

ManCom, Sustainability - HSE

ManCom, CSR ManCom, and so on

which work on identifying risks in

those specific areas and mitigating

them.

Each business has developed its

own risk matrix, which is reviewed

by its respective management

committee/executive committee,

chaired by its CEO. In addition, each

business has developed its own

risk register depending on the size

of its operations and number of

SBUs/ locations. Risks across these

risk registers are aggregated and

evaluated and the Group’s principal

risks are identified, and a response

mechanism is formulated.

This element is an important

component of the overall internal

control process from which the

Board obtains assurance. The scope

of work, authority and resources

of the Management Assurance

Services (MAS) are regularly

reviewed by the Audit Committee.

The responsibilities of MAS include

recommending improvements

in the control environment and

reviewing compliance with our

philosophy, policies and procedures.

The planning of internal audits is

approached from a risk perspective.

In preparing the internal audit plan,

reference is made to the risk matrix,

and inputs are sought from senior

management, business teams and

members of the Audit Committee.

In addition, we refer to past audit

experience, financial analysis and the

prevailing economic and business

environment.

Despite COVID-induced disruptions Vedanta’s BUs dealt with its impact extremely well, resulting in an effective response. This was made possible owing to the following:

As a result, our facilities remained

largely operational during the

pandemic, despite challenges.

Rather, the disruption created an

opportunity for us to identify and

work on certain transformational

aspects for the future. We continue

to remain committed to achieving our

objectives of zero harm, zero wastage

and zero discharge, thus creating

sustainable stakeholder value.

The order in which the risks appear in

the next section does not necessarily

reflect the likelihood of their

occurrence or the relative magnitude

of their impact on Vedanta’s

businesses. The risk direction of

each risk has been reviewed based

on events, economic conditions,

changes in business environment and

regulatory changes during the year.

While Vedanta’s risk management

framework is designed to help the

organisation meet its objectives,

there is no guarantee that the

Group’s risk-management activities

will mitigate or prevent these or

other risks from occurring.

The Board, with the assistance of the management, conducts periodic and robust assessments of principal risks and

uncertainties of the Group, and tests the financial plans for each risk and uncertainty mentioned below.

SUSTAINABILITY RISKS

Health, safety and environment (HSE)

| Impact | Mitigation | Direction |

|---|---|---|

|

The resources sector is subject

to extensive health, safety and

environmental laws, regulations

and standards. Evolving

requirements and stakeholder

expectations could result in

increased cost or litigation or

threaten the viability of operations

in extreme cases.

Emissions and climate change: Our global presence exposes us to a number of jurisdictions in which regulations or laws have been, or are being, considered to limit or reduce emissions. The likely effect of these changes could be increase in the cost for fossil fuels, levies for emissions in excess of certain permitted levels, and increase in administrative costs for monitoring and reporting. Increasing regulation of greenhouse gas (GHG) emissions, including the progressive introduction of carbon emissions trading mechanisms and tighter emission reduction targets, is likely to raise costs and reduce demand growth. |

|

|

Managing relationship with stakeholders

| Impact | Mitigation | Direction |

|---|---|---|

| The continued success of our existing operations and future projects are in part dependent on the broad support and a healthy relationship with our respective local communities. Failure to identify and manage local concerns and expectations can have a negative impact on relations and therefore affect the organisation’s reputation and social licence to operate and grow. |

|

|

Tailings dam stability

| Impact | Mitigation | Direction |

|---|---|---|

| This signifies release of waste material leading to loss of life, injuries, environmental damage, reputational damage, financial costs and production impacts. A tailings dam failure is considered to be a catastrophic risk – i.e. a very high severity but very low frequency event that must be given the highest priority |

|

|

OPERATIONAL RISKS

Challenges in Aluminium and Power business

| Impact | Mitigation | Direction |

|---|---|---|

| Our projects have been completed and may be subject to a number of challenges during operationalisation phase. These may also include challenges around sourcing raw materials and infrastructure-related aspects and concerns around Ash utilisation / evacuation |

|

|

Discovery risk

| Impact | Mitigation | Direction |

|---|---|---|

| Increased production rates from our growth-oriented operations place demand on exploration and prospecting initiatives to replace reserves and resources at a pace faster than depletion. A failure in our ability to discover new reserves, enhance existing reserves or develop new operations in sufficient quantities to maintain or grow the current level of our reserves could negatively affect our prospects. There are numerous uncertainties inherent in estimating ore and Oil & Gas reserves, and geological, technical, and economic assumptions that are valid at the time of estimation. These may change significantly when new information becomes available. |

|

|

Breaches in IT / cybersecurity

| Impact | Mitigation | Direction |

|---|---|---|

| Like many global organisations, our reliance on computers and network technology is increasing. These systems could be subject to security breaches resulting in theft, disclosure, or corruption of key/strategic information. Security breaches could also result in misappropriation of funds or disruptions to our business operations. A cybersecurity breach could have an impact on business operations. |

|

|

Loss of assets or profit due to natural calamities

| Impact | Mitigation | Direction |

|---|---|---|

| Our operations may be subject to a number of circumstances not wholly within the Group’s control. These include damage to or breakdown of equipment or infrastructure, unexpected geological variations or technical issues, extreme weather conditions and natural disasters – any of which could adversely affect production and/or costs. |

|

|

Cairn related challenges

| Impact | Mitigation | Direction |

|---|---|---|

| Cairn India has 70% participating interest in Rajasthan Block. The production sharing contract (PSC) of Rajasthan Block runs till 2020. The Government of India has granted its approval for ten-year extension at less favourable terms, pursuant to its policy for extension of Pre-NELP Exploration Blocks, subject to certain conditions. Ramp up of production vs envisaged may have impact on profitability. |

|

|

COMPLIANCE RISKS

Regulatory and legal risk

| Impact | Mitigation | Direction |

|---|---|---|

| We have operations in many countries around the globe. These may be impacted because of legal and regulatory changes in the countries in which we operate resulting in higher operating costs, and restrictions such as the imposition or increase in royalties or taxation rates, export duty, impacts on mining rights/bans, and change in legislation. |

|

|

Tax related matters

| Impact | Mitigation | Direction |

|---|---|---|

| Our businesses are in a tax regime and changes in any tax structure or any tax-related litigation may impact our profitability. |

|

|

FINANCIAL RISKS

Fluctuation in commodity prices (including oil) and currency exchange rates

| Impact | Mitigation | Direction |

|---|---|---|

|

Prices and demand for the Group’s

products may remain volatile/

uncertain and could be influenced

by global economic conditions,

natural disasters, weather,

pandemics, such as the COVID-19

outbreak, political instability, and

so on. Volatility in commodity

prices and demand may adversely

affect our earnings, cash flow and

reserves.

Our assets, earnings and cash flows are influenced by a variety of currencies due to our multi-geographic operations. Fluctuations in exchange rates of those currencies may have an impact on our financials. |

|

|

Major project delivery

| Impact | Mitigation | Direction |

|---|---|---|

| Shortfall in achievement of expansion projects’ stated objectives leading to challenges in achieving stated business milestones – existing and new growth projects. |

|

|

Access to capital

| Impact | Mitigation | Direction |

|---|---|---|

| The Group may not be able to meet its payment obligations when due or may be unable to borrow funds in the market at an acceptable price to fund actual or proposed commitments. A sustained adverse economic downturn and/or suspension of its operation in any business, affecting revenue and free cash flow generation, may cause stress on the Company’s ability to raise financing at competitive terms. |

|

|