We recorded strong operational and financial performance in FY2021 amidst the challenges faced due to the pandemic. At VEDL, we continue to focus on controllable factors such as resetting cost base through diverse cost optimisation initiatives, disciplined capital investments, working capital initiatives, marketing initiatives and volume with strong control measures to ensure safe operations across businesses within framed government and corporate guidelines amidst the pandemic.

Revenue

EBITDA

EBITDA Margin

Capital work-in-progress

EPS (before exceptional items) (FY2020: `10.79 per share)

Per share interim dividend

GLOBAL ECONOMY AND COMMODITY MARKETS

The COVID-19 pandemic and the widespread lockdowns imposed by countries in 2020 triggered the worst peacetime global contraction since the Great Depression in 1929. The subsequent and gradual easing of containment measures during the second half of the year, initially caused a strong rebound. This initial spurt in economic activity, however, lost momentum in some regions of the world towards the end of the year due to a renewed rise in infections. The recession and the pandemic-related restrictions also caused global trade to contract substantially, which hampered growth further, particularly in export-dependent economies.

The US economy suffered a major drop in the first half of the year, accompanied by a huge surge in unemployment. Owing to a vast array of monetary and fiscal measures, as well as the comparatively moderate government restrictions, the economy recovered in the second half of the year. In the first half of 2020, the pandemic and the associated containment measures also caused the economies of Eurozone to plunge into a deep recession that affected the manufacturing and services sectors equally. However, this decline varied greatly among different member states.

Although China was the epicentre of the outbreak, the country imposed one of the most stringent lockdowns to flatten the curve and bring the economy back on track. The result is that the annual industrial production in the Chinese economy declined to -13.5% during January - February 2020 but reached 7.3% in December.

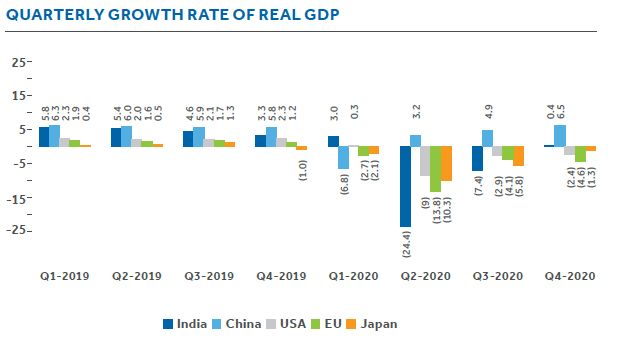

Most of the economies faced major contraction in GDP in Q2 of 2020, except for the Chinese economy, which grew 3.2% y-o-y.

IMF has reported that the global pandemic-related fiscal actions of US$146 trillion, comprising US$10 trillion in additional spending and forgone revenue and US$6 trillion government loans, guarantees, and capital injections, mitigated the contraction in economic activity

Several fiscal measures were announced by the US as relief package and stimulus to the US economy under CARES Act (estimated US$2.3 trillion or ~11% of GDP), Paycheck Protection Program and Health Care Enhancement Act (US$483 billion), Consolidated Appropriations Act of 2021 (US$868 billion or about 4.1% of GDP), American Rescue Plan (estimated US$1,844 billion or about 8.8% of GDP) etc. Such stimulus packages were primarily focused on direct stimulus payments to individuals, unemployment benefits, tax rebate, food safety, assistance to families, communities and businesses, corporate bankruptcy prevention, healthcare, international assistance etc. The federal funds rate was lowered by 150bp in March to 0-0.25bp to facilitate credit flow and relieve the stress in the economy. Federal Reserve also introduced facilities to support credit flow, in some cases backed by the treasury using funds appropriated under the CARES Act.

The package of €540 billion provided by the European Commission was targeted towards Pandemic Crisis Support, government guarantees to European Investment Banks, and job protection. EU also finalised the agreement on the Next Generation EU (NGEU) recovery fund which will provide €750 billion through borrowing at the EU level. The European Central Bank (ECB) also introduced new and extended existing monetary policy supports.

The Government of China announced a stimulus of RMB 4.8 trillion (4.7% of GDP) for spending on epidemic prevention and control, production of medical equipment, unemployment mitigation, tax relief, and additional public investments. The stimulus packages injected by the economies helped accelerate GDP growth that had faced a significant decline in the initial quarters.

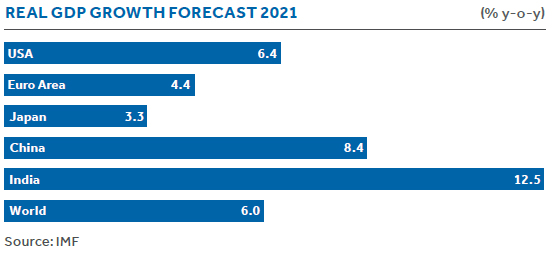

Following the vaccine rollout and backed by stimulus packages, CY2021 GDP growth is likely to be high (chart IMF GDP growth of major economies). However, the recovery is not even and varies widely among advanced economies, emerging economies and developing economies. Government support also brings about elevated debt levels.

With over 136 million confirmed cases of COVID-19 and 2.9 million deaths worldwide reported by WHO till 13 April 2021, the world is still facing a crisis to contain the virus and resume economic activities. Policy measures COVAX, convened by WHO and CEPI GAVI have been initiated to support homogeneous vaccination worldwide.

Globally, monetary, and fiscal policies have been targeted to mitigate the adverse effect of the pandemic. Initiatives were taken to encourage private sector investments, which will subsequently spur the commodity demand worldwide. With metal prices going back to the pre‑COVID level and the recovery of the manufacturing industries, Vedanta has a positive outlook to benefit from the commodity market revival.

The revival of the Chinese economy, driven by the improvement in the infrastructure sector has been a major contributor to bring back the price level of the metals and minerals market. Upcoming infrastructure plans to become the global leader in high-tech and innovative industries will drive the domestic primary metal demand, creating export opportunity for producers. Vedanta, with a substantial share in the export market, is looking forward to fulfilling the global demand.

As the economy gradually regains its pre-COVID momentum and as mobility increases, oil demand is expected to surge. This is likely to revive by the latter half of the year due to the ongoing lockdown in certain regions. The widespread vaccination initiatives will further encourage economic activities to normalise by the end of the year, accelerating the bounce-back of the Oil & Gas market.

Our diversified commodity portfolio and emphasis on cost and digital implementation position us well to take advantage of the expected demand revival, and the resulting improvement in commodity prices.

INDIAN ECONOMY

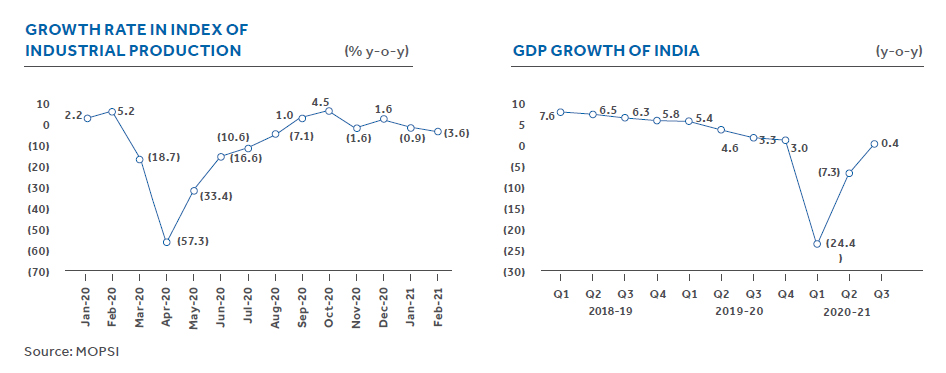

India continues to be Vedanta’s primary market, and the V-shaped recovery of the economic performance of India in FY2021 is positive for us. COVID-19 was particularly challenging for the Indian economy with a prior slow growth rate, declining exports, rising inflation, and a downturn in manufacturing output. The index of industrial production (IIP) declined drastically to -57.3% in April 2020 following nationwide stringent lockdown across India, halting economic activities. The country’s GDP growth also spun into negative territory, declining by 24.4% in the Q1FY2021.

To prevent the country’s GDP from contracting further and to bring it back into positive territory, the Government of India took bold, swift and unconventional initiatives. It announced a special economic and comprehensive package under ‘AatmaNirbhar Bharat Abhiyaan’ of `20 lakh crore – equivalent to 10% of India’s GDP – to combat the pandemic-induced stress.

Complementing the government’s fiscal measures, the RBI adopted proactive steps to inject liquidity into the economy and to provide relief to COVID-hit sectors. It reduced the repo rates to 4% and reverse repo rates to 3.35% and implemented a moratorium on the payment of term loans.

The Micro, Small and Medium Enterprises (MSME) sector was hardest hit by the pandemic. Two major schemes such as the Emergency Credit Line Guarantee Scheme (ECLGS) and the Credit Guarantee Scheme for Subordinate Debt (CGSSD) were introduced by the Government of India to provide emergency relief. These initiatives were complemented by various monetary and regulatory measures by the RBI in the form of interest rate cuts, higher structural and durable liquidity, moratorium on debt servicing, asset classification standstill, loan restructuring package and Cash Reserve Ratio (CRR) exemptions on credit disbursed to first-time MSME borrowers.

In the concluding months of FY2021, growth in e-way bills, railway freight, steel consumption, automobile sales and electricity generation were observed. This indicates V-shaped recovery of the economy. The necessary interventions by the government helped the economy revive from the low of Q1FY2021 to register a small positive growth of 0.4% in GDP in Q3FY2021.

India has rolled out the world’s largest vaccination drive to inoculate close to 1.4 billion people. Accelerated vaccination will help resume the suspended economic activities and will improve the affected industries in the country. The success of the vaccination drive will also create a positive outlook for the economy, going forward.

The IMF has projected an impressive 12.5% growth rate for India in 2021. This suggests that India’s GDP growth rate is likely to be the fastest in the world among the major economies in 2021. The large-scale capital expenditure announced by the Government of India in the Union Budget 2021-22 will support economic activity and investment. The capex cycle, triggered by the government, is likely to crowd in private investment, which is expected to drive economic growth, and consequently, more opportunities for business and employment generation. However, the recent surge in COVID-19 cases in India may pose some constraints in the growth prospect of India.

Aatmanirbhar Bharat Package

As a part of the economic package under ‘AatmaNirbhar Bharat Abhiyaan’ several structural reforms were announced by the Hon’ble Finance Minister, including mineral and coal sectors. Some of the major focus areas relating to the mineral and coal sectors are highlighted below:

Commercial coal mining – In a major policy reform, the Hon’ble Prime Minister launched the auctioning of commercial coal mining. This was aimed at fully opening the coal and mining sectors for competition, capital, participation, and technology to make the coal mining sector self-reliant. This will have a positive impact on coal-consuming sectors such as steel, aluminium, fertilisers, and cement. Salient features of this reform include revenue sharing-based auction methodology from earlier fixed rupees per tonne-based auction of coal blocks, permission for commercial exploitation of coal bed methane, rebates in revenue share payments in the event of early production of coal from the coal mine, and so on. Vedanta is advocating for similar incentives to be provided for other minerals.

Iron & steel, aluminium and copper identified as key sectors for exports –The Government of India has identified 20 sectors in which India can meet domestic demand as well as become a ‘global factory of the world’ by growing exports and reining in costly imports. Iron & steel, aluminium and copper are included in this list. The Ministry of Commerce & Industry will conduct further study on these sectors to look into areas to enhance export competitiveness.

Production – Linked Incentive (PLI) Scheme – To bolster investments in domestic manufacturing, the Union Cabinet of India has unveiled the PLI Scheme in 10 key sectors. This is also a part of India’s endeavour towards self-reliance through enhancing India’s manufacturing capabilities and increasing exports. The ten sectors are – (1) Advance Chemistry Cell (ACC) Battery, (2) Electronic/Technology Products, (3) Automobiles & Auto Components, (4) Pharmaceuticals drugs, (5) Telecom & Networking Products, (6) Textile Products, (7) Food Products, (8) Solar PV Modules, (9) White Goods (ACs & LED) and (10) Specialty Steel. The scheme has approved financial outlay of `1,45,980 crore over a five-year period. This is apart from already notified PLI schemes in the mobile manufacturing and pharmaceutical sector with a financial outlay of `51,311 crore.

Although non-ferrous base metal manufacturing sector has not been considered for the PLI scheme, the sector will indirectly benefit from higher metal demand from increased manufacturing of battery, automobile, solar PV module, white goods, and specialty steel.

Marketing freedom for natural gas – Taking a significant step towards gas-based economy with the objective of increasing domestic production of natural gas, the Cabinet Committee on Economic Affairs has approved ‘Natural Gas Marketing Reforms’.

Union Budget for 2021-22 – The Union Budget has proposed `5.54 lakh crore for capital expenditure for 2021-22 which is 34.5% more than the BE (Budget Estimate) of 2020-21, which will increase demand for products made with metals and minerals as key raw material. Proposal to set up Development Financial Institution (DFI) for infrastructure financing for a lending portfolio of at least `5 lakh crore in three years’ time is a big boost for infrastructure development which will augment demand for metals and minerals.

The increased allocation to several schemes such as Road Transport, Jal Jeevan Mission, Metro Projects, Strengthening of Power Systems, and New and Renewable Energy will drive the demand for commodities.

The Government of India’s roadmap on disinvestment of public sector enterprises in all non-strategic and strategic sectors along with monetisation of non-core assets of PSEs provides investment opportunities to private sector in good quality assets.