INVESTMENT CASE

Built to deliver

sustainable value

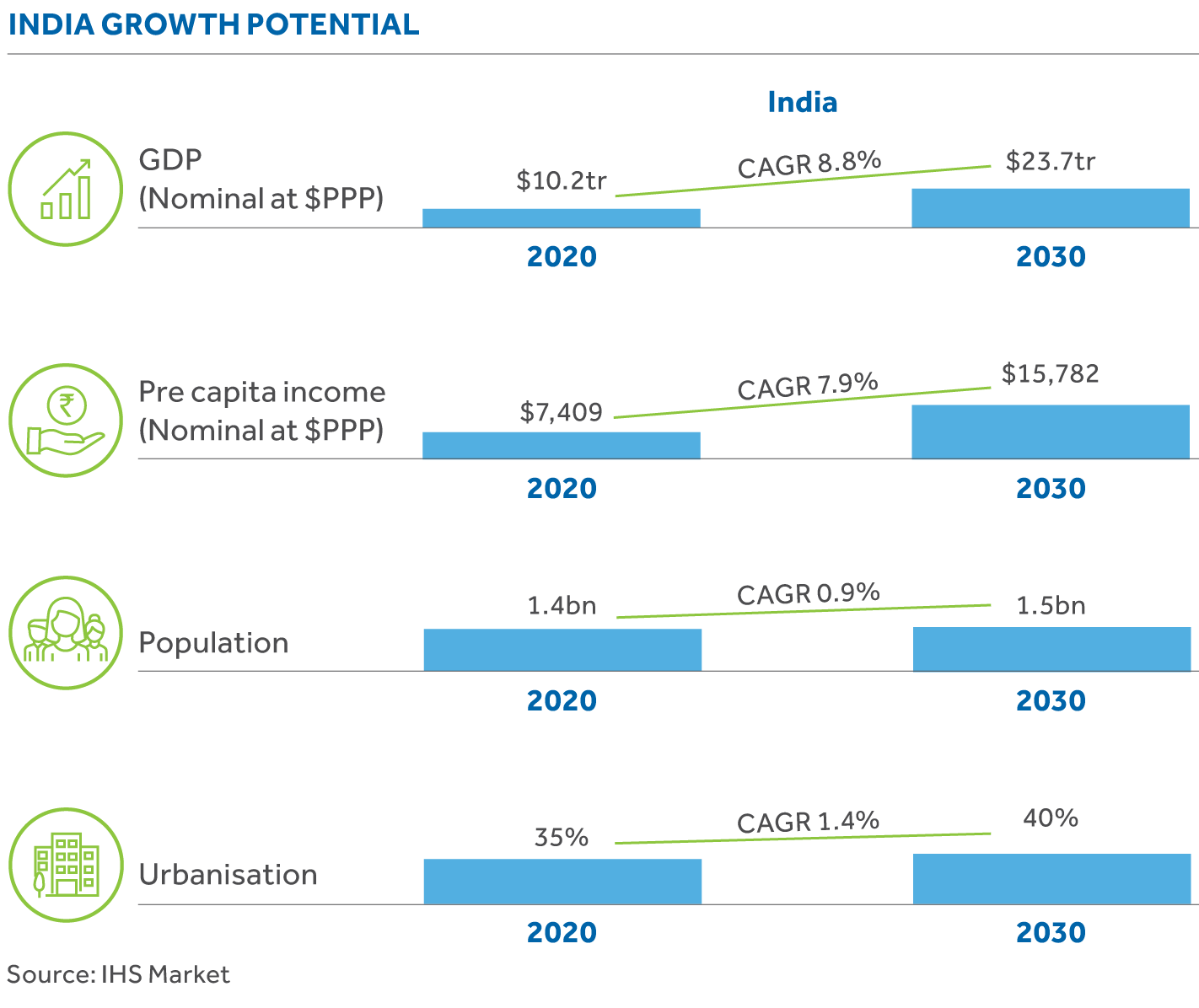

Natural resources represent an important growth engine for the Indian economy, which

is poised to grow attractively in the foreseeable future. As India’s only diversified natural

resources company, we are well placed to make a significant contribution to the nation’s

growth. Our investment strategy is focused on delivering sustainable, long-term returns

to our shareholders and creating value for our wider stakeholder fraternity.

Large, low-cost, long-life and diversified asset

base with an attractive commodity mix

- Large-scale, diversified asset

portfolio, with an attractive cost

position in many core businesses,

positions us to deliver strong

margins and free cash flows

through the commodity cycle

- An attractive commodity mix,

with strong fundamentals and

promising demand growth; key

focus on base metals and oil

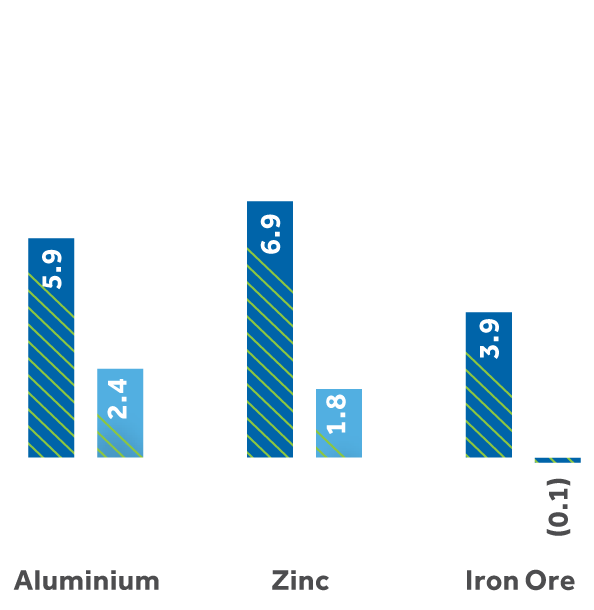

While commodity markets suffered during the first half of 2020 due to COVID-19, with the base metals sector experiencing reduced demand from manufacturing, and oil price suffering from severe demand weakness owing to travel restrictions and prolonged factory shutdowns, the second half of the year saw recovery, particularly in Vedanta’s core commodities (zinc, aluminium and oil & gas). In 2021, various efforts to stimulate economic growth by governments, central banks and international institutions, together with faster vaccine rollout are likely to strengthen the recovery in these commodity markets.

DEMAND 2020-2030 CAGR (%)

India Demand

India Demand

Global Demand

Global Demand

Vedanta Limited Comodity Presence

Vedanta Limited Comodity Presence

Source: Wood Mackenzie

Note: Oil demand CAGR show for 2018-2030 period

Ideally positioned to capitalise on India’s growth

and natural resources potential

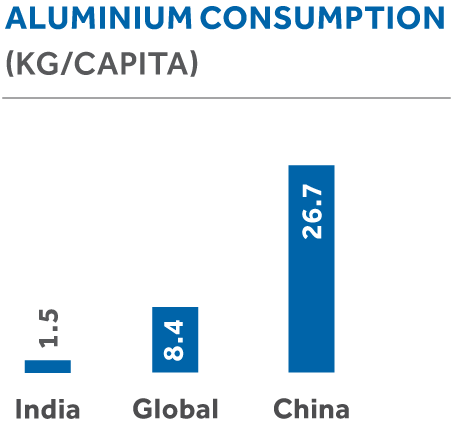

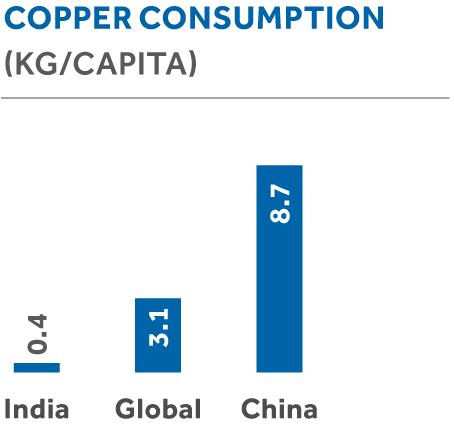

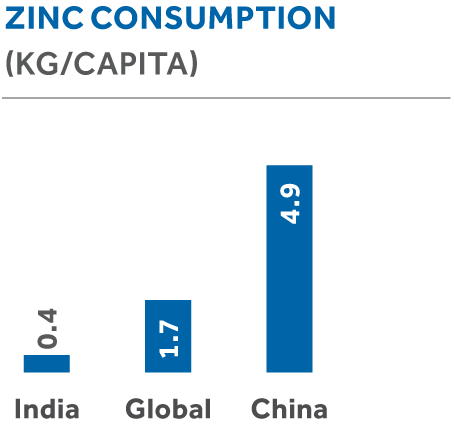

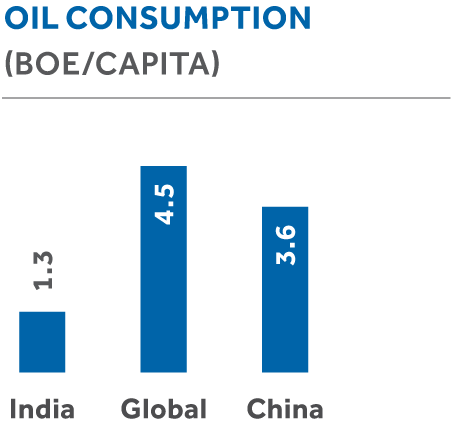

- India’s (US$2.7 trillion economy) per capita metal consumption is significantly lower than the global

average, indicating significant headroom for growth.

- The government’s continued focus on infrastructure, urbanisation, and affordable housing (supported

by low interest rates regime driven by the RBI’s accommodative monetary policy) will help the economy

recover faster from the COVID-induced shock and generate strong demand for natural resources.

VEDANTA’S COMPETITIVE ADVANTAGE IN INDIA

- A diversified portfolio of established operations in India.

- A strong market position as India’s largest base metals producer and largest private sector oil producer.

- An operating team with an extensive track record of successful project execution

Source : Wood Mackenzie, IMF, IHS Markit, BMI, BP Energy outlook 2020

Note : All commodities demand correspond to primary demand; figures are for 2021

Source : Wood Mackenzie, IMF, IHS Markit, BMI, BP Energy outlook 2020

Note : All commodities demand correspond to primary demand; figures are for 2021

India’s mineral reserves ranking globally

8th

Zinc

Reserves: 10.0 mn tonnes

Crude oil

Reserves: 4.4bn bbl

7th

Iron ore

Reserves: 5.5 bn tonnes

8th

Bauxite

Reserves: 660 mn tonnes

Source: USGS Mineral

Commodity Summaries

2021, OPEC Annual Statistical

Bulletin 2020.

Well-invested assets driving free cash flow growth

- Completed a significant proportion of our medium-term capital expenditure programme; and we are

now ramping up production to take advantage of our

expanded capacity

- Seeing positive outcomes of our investments, with

Zinc India and aluminium delivering robust production

in the past year; and we expect Zinc International,

particularly the Gamsberg project, to provide further

impetus to our Zinc business, going forward

- In the Oil & Gas business, we have begun to

implement our growth projects with a gross capex of

US$3.2+ billion, enabling us to grow our volumes in the

near term. These increases in production are leading

to a strong cashflow generation

Operational excellence and technology driving

efficiency and sustainability

- Eliminating inefficiencies across every aspect of operations

- Leveraging advanced technologies to roll out a

wide range of innovation

- Rationalising the cost structure to build a leaner

operating model

- Ensuring sustainable operations and delivering a

positive result for all our stakeholders and society

Strong financial profile

Our operating performance, coupled with optimisation

of capital allocation, has helped strengthen our financials.

- Revenues of ₹86,863 crore and EBITDA

of ₹27,341 crore

- Deleveraging and extending our debt maturities

through proactive liability management exercises

- Strong and robust FCF of ₹13,821 crore

- Cash and liquid investments of ₹32,614 crore

- A strong balance sheet, with respect to Net Debt/

EBITDA (0.9x) and gearing, compared to our global

diversified peers

- Interim dividend of ~₹3,500 crore paid in FY2021

RETURN ON CAPITAL EMPLOYED (%)

Committed to the highest standards of ESG

- Committed to be the lowest cost producer in a sustainable manner

- Strong ROCE of ~19 %

- Aligned to our Group objective of ‘Zero Harm, Zero

Waste and Zero Discharge’, we worked dedicatedly to

set up a framework, aligned to global best practices

- Focusing on key material areas of occupational health,

safety, environment, carbon, social performance and

governance

- Key future programmes comprise the following:

achieve highest safety level, manage zero net

environmental damage, support global carbon

neutrality targets and work with all stakeholders in

harmony

We have made significant improvements in our

investigation quality to avoid repeat accidents and

promote higher reporting for all incidents. We are also

duly progressing towards achieving our water and

waste targets set for the year.

WATER CONSUMED & RECYCLED (mil m3)

India Demand

India Demand

Global Demand

Global Demand

Vedanta Limited Comodity Presence

Vedanta Limited Comodity Presence